What will 2024's historic elections mean for currency markets?

2024 could well be a watershed year for the world. Just as central banks look to guide global economies away from recession, key elections in over 50 countries threaten the recovery.

The US and UK elections will receive a lot of column inches this year, but where will they leave currency markets? Will central banks be able to navigate turbulence as they move away from high interest rates? This is the year we’ll find out.

To read more on the outlook for 2024 and Q1, download our latest Quarterly Forecast today.

How to price in risk

We took soundings from leading banks and gathered predictions from the world’s biggest financial institutions to make our forecast. You’ll find a full list of predictions in our report, but below are the main takeaways for the pound, the euro and the US dollar.

Banks variously forecast GBP/USD to climb as high as 1.37 and as low as 1.17 in the first quarter. There is a fairly large discrepancy with these figures, mainly due to ongoing uncertainty in the geopolitical landscape.

Forecasts for GBP/EUR have a much smaller range – between just 1.19 and 1.19 in the first quarter. This reflects the weaker position of the UK and European economies, as well as the two currencies having less bearing on worldwide central bank holdings.

EUR/USD has a maximum forecast of 1.19 and a minimum of 1.04. Markets are increasingly expecting the European Central Bank (ECB) and Federal Reserve to be the first to cut interest rates, so expect some volatility should expectations shift.

A fork in the road

Exchange rates are always susceptible to market-moving events, but this year feels like the ultimate test. There will be an eye on economic performance as policymakers look to gauge their loosening cycles. However, the big events of the year take place at the ballot box.

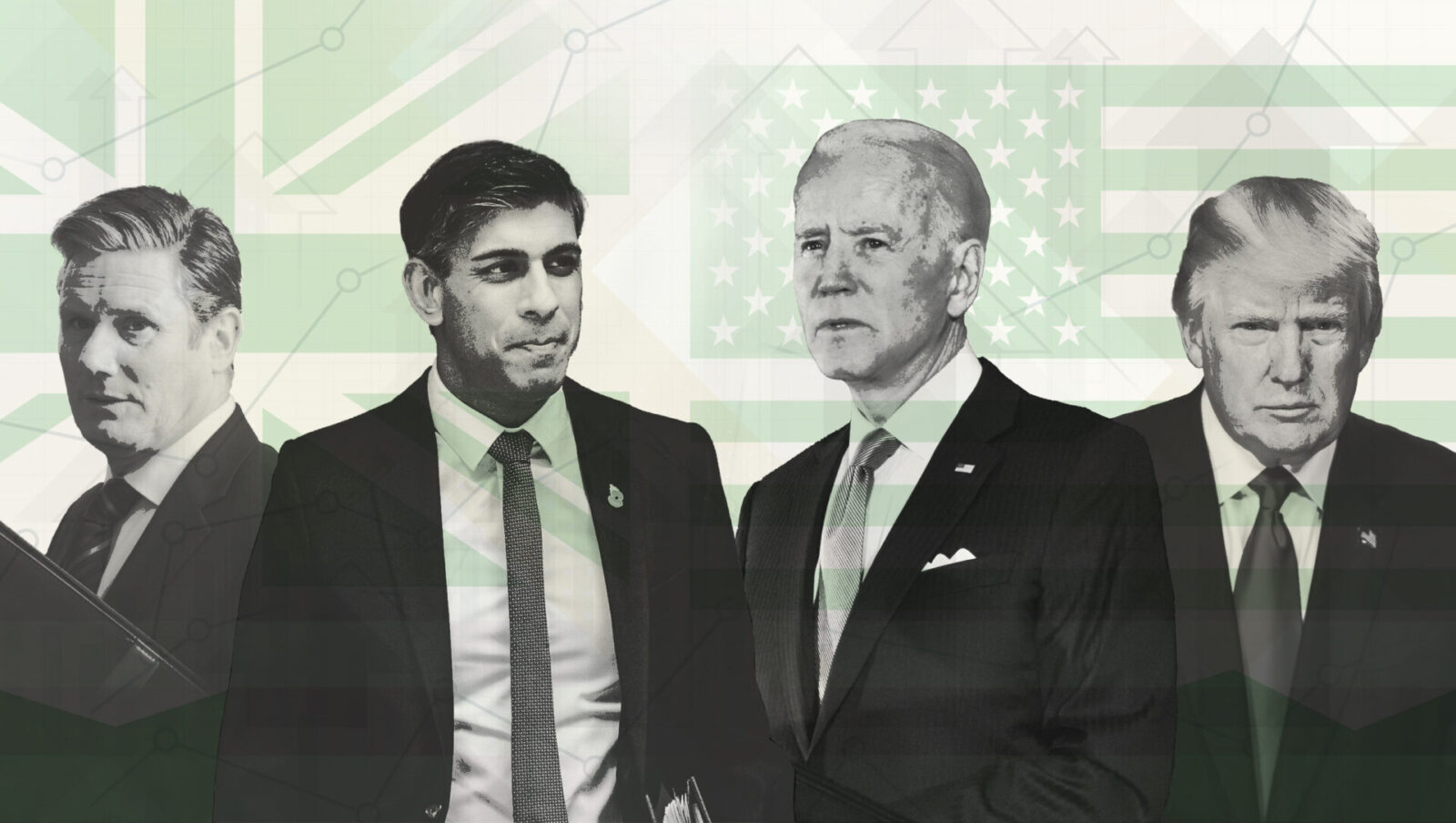

UK Prime Minister Rishi Sunak recently indicated his “working assumption” was for an Autumn election. Don’t rule out political opportunism though as Conservative strategists look to capitalise on good economic news. UK inflation is now running under 4%, but growth remains weak and polls indicate Labour leader Keir Starmer would cruise to victory if the vote were held today. It will be a fascinating few months as markets digest political developments and what a Labour government would mean for the economy.

Despite recent grandstanding, it seems inevitable that Donald Trump and Joe Biden will collide for a rerun of the previous presidential election. In the US, the Federal Reserve is under mounting pressure to cut rates, while Joe Biden has been tarnished by a period of rapid inflation. We don’t often talk about a “risk premium” with the US dollar, but the looming shadow of Trump may well lead to some weakness in the runup to November’s ballot.

Forecasts are great, but. . .

With all that’s going on in 2024, currency markets will likely change fast. Here at Smart Currency Business, we advocate for a proactive risk management strategy that protects your margins from volatility. With the best will in the world, no bank (no matter how qualified their analysts) could ever hope to accurately predict every move in the currency.

So stick with us: we’ve been doing this for 20 years now and have the nouse and experience to guide you through choppy waters.

Sweeping shifts in the political landscape will inevitably result in volatility. Smart Currency’s goal is to protect your money from market fluctuations through a range of solutions, from market options to forward contracts. Be sure to check out our SmartHedge feature as well, which allows your firm to visualise and adjust its currency exposures in real-time.

To make sure your upcoming transactions are protected against the risks of sudden market movements, call your Account Manager on 020 7898 0500 to discuss a forward contract; alternatively, if you’re new, please register with Smart Currency Business today.

020 7898 0500

020 7898 0500