Collar Options

Collar options are structured options that provide you with a known worst-case rate (known as the protection rate) and a best-case rate (known as the collar rate), which you can use to transact on a given date in the future. You are able to participate in favourable movements in the spot rate between the participation and collar rates.

Collar options are generally structured as zero-premium products, but they can be structured with a premium in order to help you achieve more favourable terms from the outset.

How do collar options work?

For importers, collar options are structured by entering into two concurrent options:

- In the first, you purchase a put option from Smart Currency Options Limited (SCOL), giving you the right, but not the obligation, to sell the notional amount to SCOL at the protection rate.

- In the second, you sell a call option to SCOL at the protection rate, which will oblige you to transact the notional amount at the collar rate, should the spot rate be more favourable than that rate at the expiration time and date.

Collar options example:

A UK-based company imports materials from the US and needs to pay a supplier $500,000 in six months’ time.

1. Requirements

The company:

- would like to benefit from a favourable exchange rate and 100% rate protection

- is willing to pay a premium for this

2. Current Forward Rate

The forward rate for a six-month period is

1.3200

3. Solution

The company is prepared to accept a protected rate of 1.3000. The company buys a collar with a protected rate of 1.3000 and a best-case rate of

1.3650

There are three possible scenarios

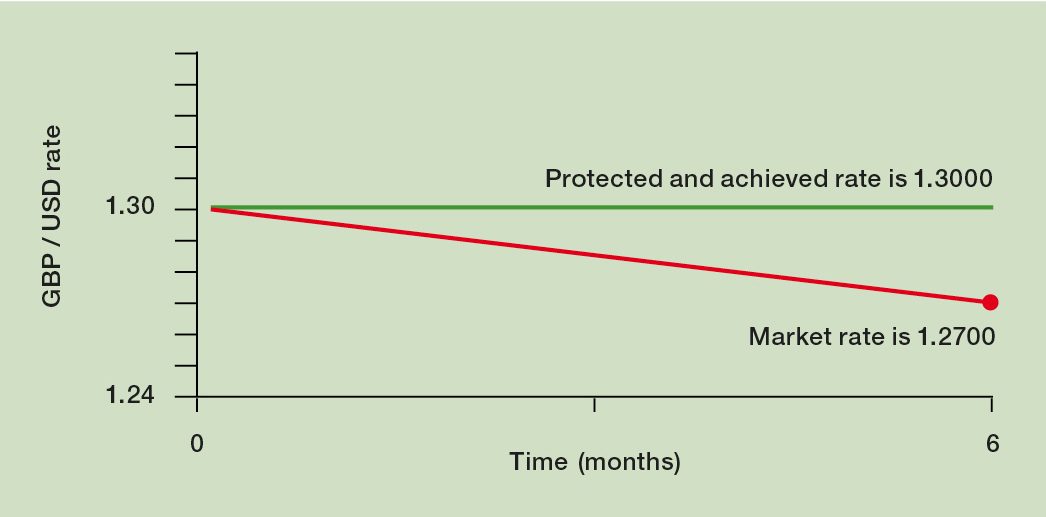

Scenario 1:

Unfavourable market moves

GBP/USD weakens. At maturity, the exchange rate is 1.2700. The company is entitled to buy the full $500,000 at 1.3000.

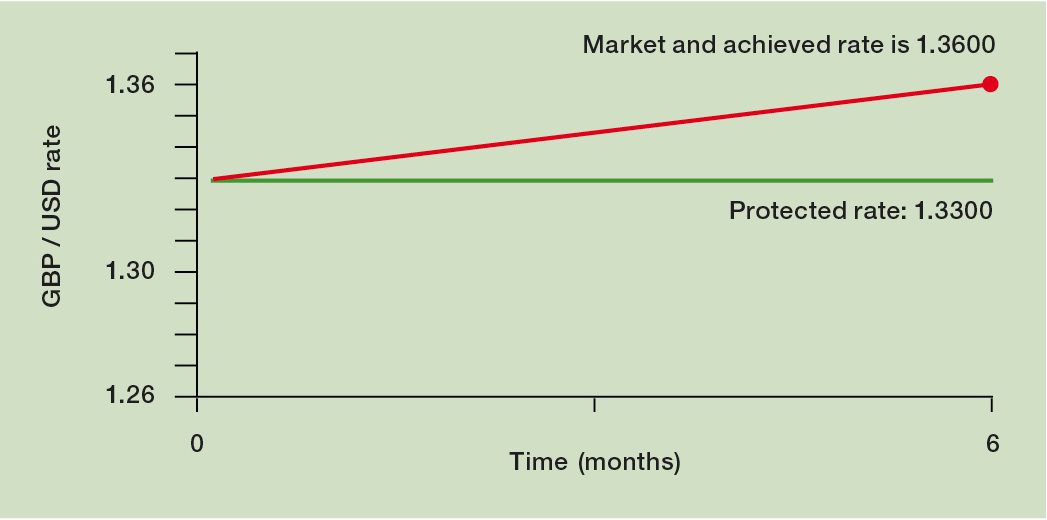

Scenario 2:

Favourable market moves – in-between the protected rate and best-case rate

GBP/USD strengthens. The exchange rate at maturity is 1.3600, which is in-between the protected rate and best-case rate. The company is entitled to buy dollars in the spot market at 1.3600.

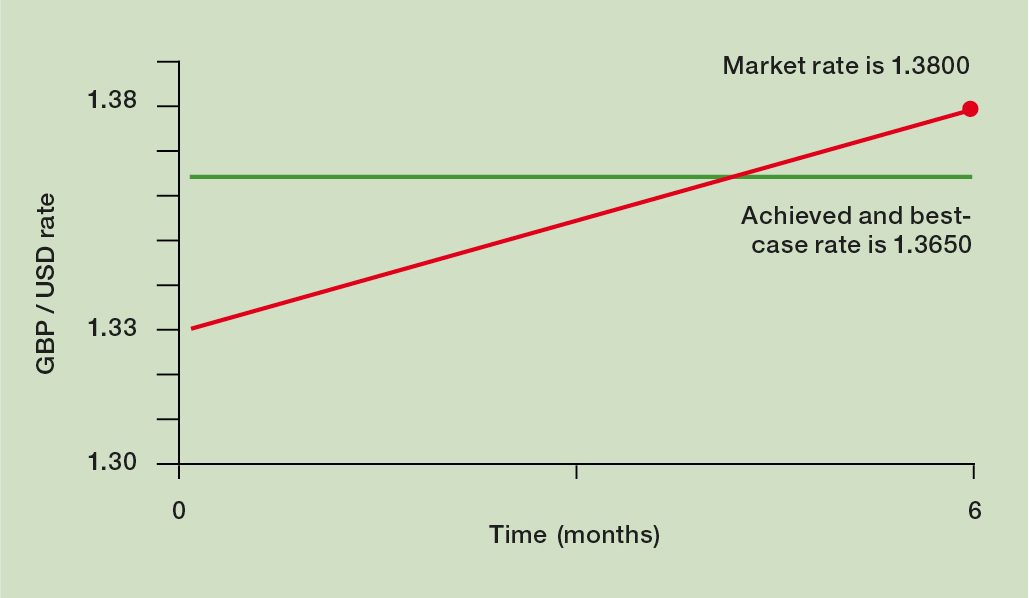

Scenario 3:

Favourable market moves, above the best-case rate

GBP/USD strengthens. On expiry, it is trading at 1.3800, which is above the company’s best-case rate. The company is obliged to purchase dollars at 1.3650.

Advantages of collar options

- Collar options are generally structured as zero-premium

- They guarantee protection at a known worst-case rate (protection rate)

- They give you the ability to participate in favourable exchange rate movements, as far as the collar rate

- Collar options offer a slightly more favourable mark-to-market profile than the equivalent forward contract

Disadvantages of collar options

- Participation in favourable exchange rate movements is capped at the collar rate, meaning that you will not be able to benefit in all favourable movements in the spot rate

- Collar options are subject to a variation margin. If the spot rate moves significantly prior to expiry, SCOL may ask you to pay a deposit (also known as a margin call)

- The protection rate is less favourable than the equivalent forward contract

Key facts

- A deposit and/or variation margin may be applicable in line with SCOL terms of business

Fill in this quote form and discuss your requirements with us

Disclaimer:

Option contracts are offered by Smart Currency Options Limited (SCOL) on an execution-only basis. This means that you must decide if you wish to obtain such a contract, and SCOL will not offer you advice about these contracts.

This material provides you with generic and illustrative information and in no way can it be deemed to be financial, investment, tax, legal or other professional advice, a personal recommendation or an offer to enter into an option contract and it should not be relied upon as such. Any changes in exchange rates and interest rates may have an adverse effect on the value, price or structure of these instruments.

SCOL shall not be responsible for any loss arising from entering into an option contract based on this material. SCOL makes every reasonable effort to ensure that this information is accurate and complete but assumes no responsibility for and gives no warranty with regard to the same.

Foreign exchange options can carry a high degree of risk and are not suitable for everyone as they can have a negative impact on your capital. If you are in doubt as to the suitability of any foreign exchange product, SCOL strongly encourages you to seek independent advice from suitable financial advisers.

Consulting a website or receiving a publication does not constitute a customer relationship and SCOL shall not have any duty or incur any liability or responsibility towards any person or entity as a result thereof.

SCOL is a wholly-owned subsidiary of Smart Currency Exchange Limited, and is authorised and regulated by the Financial Conduct Authority to carry out MiFID business with reference number 656427.

SCOL is a private company limited by shares registered in England and Wales. Company number 9034947. The registered office address is at 1 Lyric Square, Hammersmith, London W6 0NB.

020 7898 0500

020 7898 0500