Forward extra

A forward extra structure provides a secured protected rate, while still allowing beneficial moves up to a pre-determined trigger level. If the trigger level is met or exceeded at any time during the life of the trade, the holder of the forward extra is obliged to deal at the protected rate.

If the rate on expiry is in-between the trigger level and protected rate, the holder of the forward extra can transact at the spot rate. If the spot rate at expiry is less favourable than the protected rate the holder of the forward extra can transact at the protected rate. Forward extras are generally structured as zero-cost premium products.

An example of how a forward extra works

A UK-based company imports materials from the US and needs to pay a supplier $500,000 in six months’ time.

1. Requirements

The company:

- would like to benefit from a favourable exchange rate and 100% rate protection

- is willing to pay a premium for this

2. Current Forward Rate

The forward rate for a six-month period is

1.3300

3. Solution

The company is prepared to accept a worst-case rate of 1.3200. The company buys a forward extra with a trigger level at 1.3800. The company buying the forward extra does not believe that the GBP/USD rate will exceed 1.3800 during the life of the option.

There are three possible scenarios

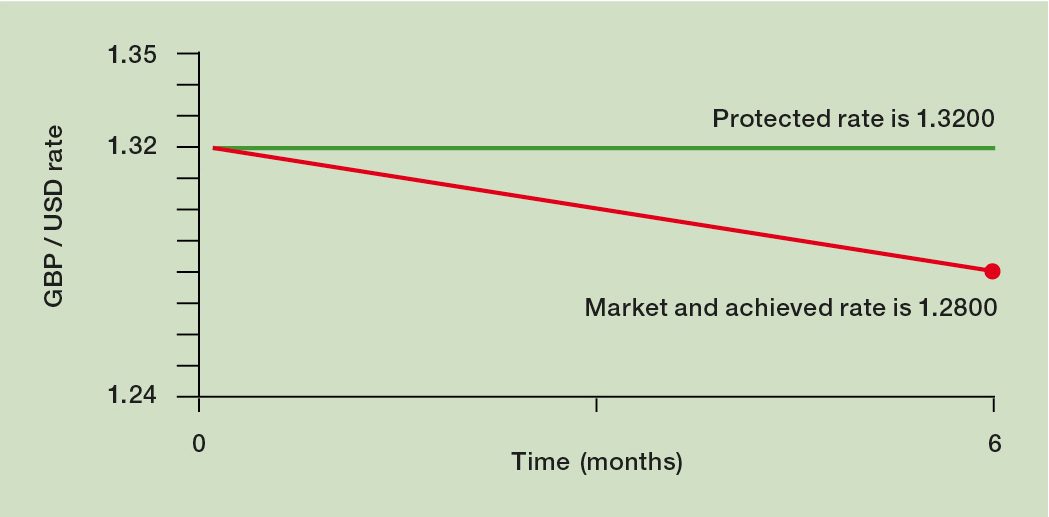

Scenario 1:

Unfavourable market moves

GBP/USD weakens. At maturity of the contract the exchange rate is 1.2800. The company is entitled to buy dollars at 1.3200.

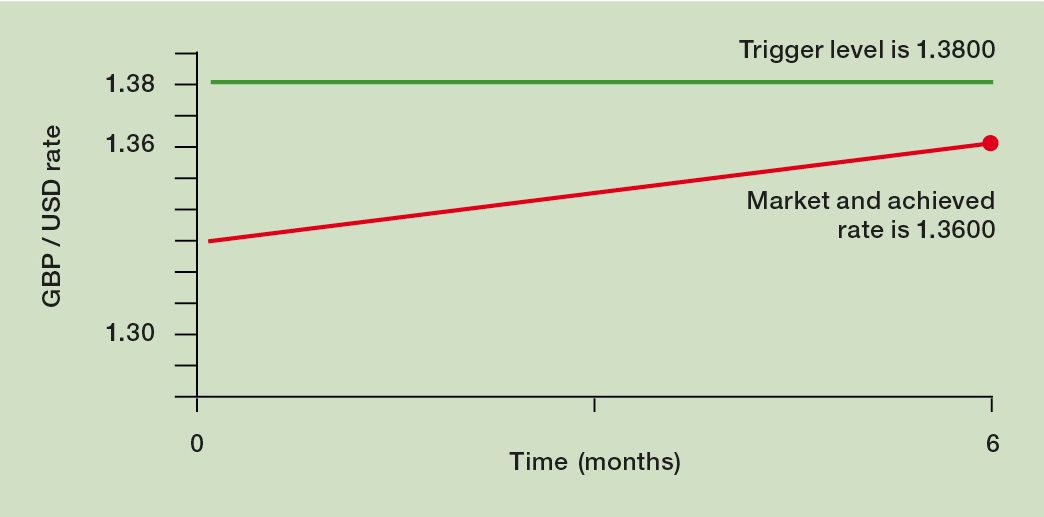

Scenario 2:

Favourable market moves – does not reach the trigger level

GBP/USD strengthens. At maturity, the exchange rate is 1.3600 (but the trigger level of 1.3800 has not been breached during the life of the contract). The company can buy the dollars in the spot market at 1.3600.

Scenario 3:

Favourable market moves, trading through the trigger level

GBP/USD strengthens, and trades through the trigger level of 1.3800 at any time during the life of the option contract. The company is obliged to buy dollars at 1.3200.

Advantages of the forward extra

- Provides protection on 100% of the company’s exposure

- Allows the company to benefit in full from favourable currency moves up to a pre-determined level

- No premium payable

Disadvantages of the forward extra

- If the trigger level is hit or exceeded at any time during the life of the contract, the company is obligated to deal at the protected rate

- The protected rate will generally be less favourable than the forward rate

Key facts

- Deposit and/or variation margin may be applicable in line with SCOL terms of business

Fill in this quote form and discuss your requirements with us

Disclaimer:

Option contracts are offered by Smart Currency Options Limited (SCOL) on an execution-only basis. This means that you must decide if you wish to obtain such a contract, and SCOL will not offer you advice about these contracts.

This material provides you with generic and illustrative information and in no way can it be deemed to be financial, investment, tax, legal or other professional advice, a personal recommendation or an offer to enter into an option contract and it should not be relied upon as such. Any changes in exchange rates and interest rates may have an adverse effect on the value, price or structure of these instruments.

SCOL shall not be responsible for any loss arising from entering into an option contract based on this material. SCOL makes every reasonable effort to ensure that this information is accurate and complete but assumes no responsibility for and gives no warranty with regard to the same.

Foreign exchange options can carry a high degree of risk and are not suitable for everyone as they can have a negative impact on your capital. If you are in doubt as to the suitability of any foreign exchange product, SCOL strongly encourages you to seek independent advice from suitable financial advisers.

Consulting a website or receiving a publication does not constitute a customer relationship and SCOL shall not have any duty or incur any liability or responsibility towards any person or entity as a result thereof.

SCOL is a wholly-owned subsidiary of Smart Currency Exchange Limited, and is authorised and regulated by the Financial Conduct Authority to carry out MiFID business with reference number 656427.

SCOL is a private company limited by shares registered in England and Wales. Company number 9034947. The registered office address is at 1 Lyric Square, Hammersmith, London W6 0NB.

020 7898 0500

020 7898 0500