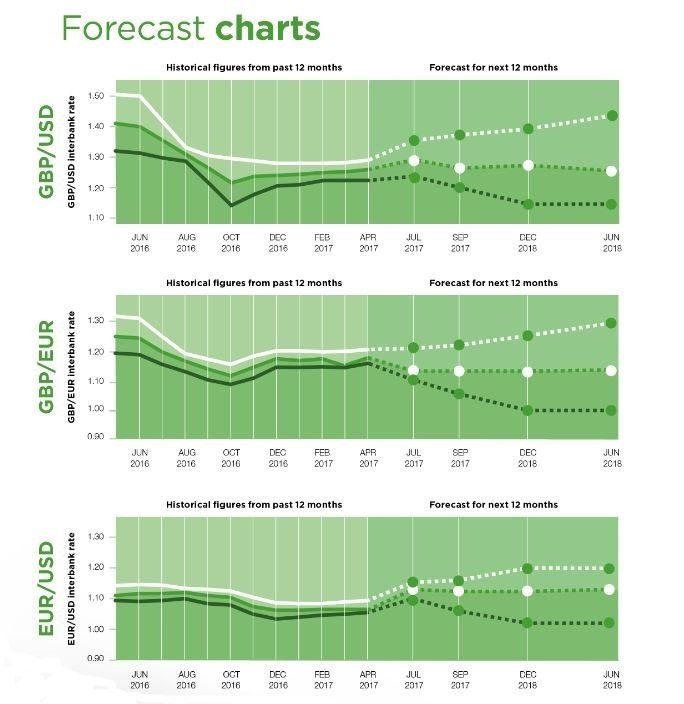

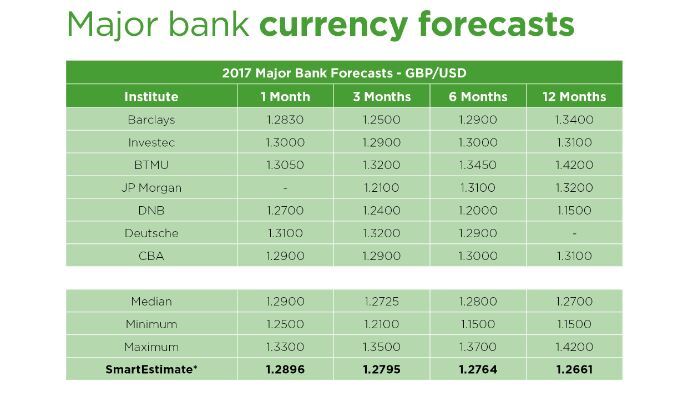

The main aim of this currency forecasts update is to highlight how important currency risk management can be, especially in these uncertain times. The forecast charts below show the disparities between the forecasted highs and lows and – let’s be clear – these figures are taken from some of the most reputable banks in the world. We also highlight factors that contribute to the difficulty in forecasting currency exchange rates with any accuracy. The variables seem to be infinite.

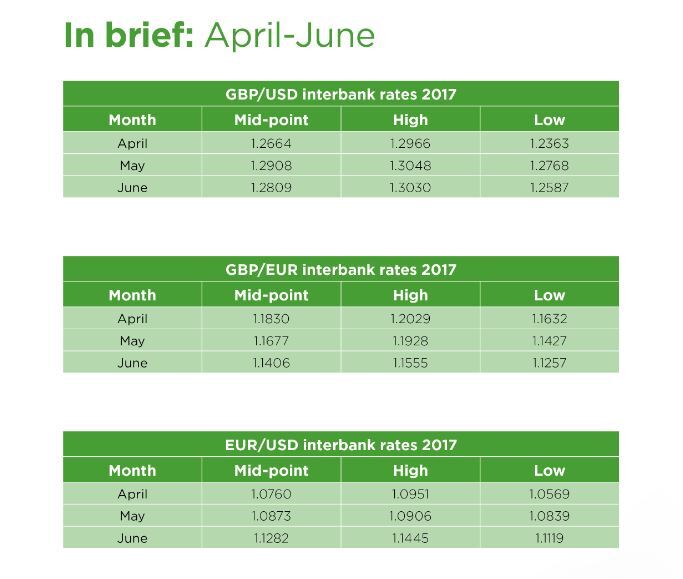

Source: Netdania and Reuters Smart Estimate by StarMine, a division of Thomson Reuters. Forecast accurate as of 20 July 2017.

If the major banks can’t even agree on what is going to happen to currency pairings in the next month, three months, six months and one year, then what chance have the rest of us got? At their best, forecasts can be considered useful guides to what could happen. At their worst, they can be dangerous and cost you a lot of money if you make a decision based on them which turns out to be wrong.

That’s why we’re passionate about working with our clients to really make them understand that the current wave of political and economic uncertainty is not something that is likely to go away anytime soon. The resultant volatility in currencies can hurt a company’s bottom line, profits and margins, and be detrimental to your cash flows. We’re not scaremongering – this is a genuine possibility unless the correct measures are put in place.

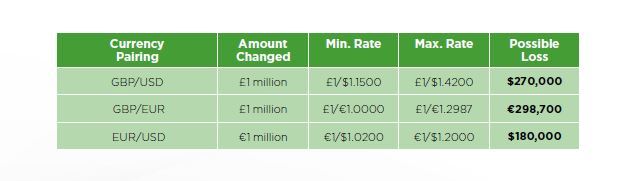

In this currency forecasts update, we want to show how – much like the major banks – we don’t have a crystal ball; the truth is nobody knows what is going to happen from one day to the next. That’s why we emphasise to our clients just how important currency risk management solutions can be – perhaps now more than ever. By way of one example, the minimum rate prediction for GBP/EUR over the next year is £1/€1.0000, while the maximum is £1/€1.2987. That discrepancy amounts to a potential loss of almost €300,000.

Hence our passion for communicating the potential ramifications of this current climate of uncertainty.

An eventful second quarter of 2017

The second quarter of 2017 was arguably more eventful than the first and, when we consider that the first quarter saw Donald Trump’s inauguration, the triggering of Article 50 and Geert Wilders’ defeat in the Dutch general election, that’s no mean feat.

Emmanuel Macron’s victory in the French presidential election abated fears of a rise in populism and the far-right across Europe, while Theresa May shocked the UK by calling a snap general election despite ridiculing the idea in the months leading up to it. While May was clearly trying to secure a mandate for her vision of how Brexit negotiations should play out, the hung parliament result rendered her position as UK Prime Minister far from strong or stable.

While the Conservatives eventually managed to secure a ‘confidence and supply’ arrangement with the Democratic Unionist Party, May’s tenure still hangs in the balance. Indeed there is increased speculation that other Tory MPs won’t support May as leader if another general election is called.

Meanwhile, the Trump administration continue to charter unprecedented waters. Following continuous speculation about collusion between the Trump campaign and Russia, Donald Trump Jr. published an email chain on Twitter in which he delighted in the possibility of uncovering some information of Hillary Clinton. While Trump Jr. has insisted his father knew nothing of the communications, the White House recently confirmed that Trump Sr. had a second, previously undisclosed meeting with Vladimir Putin at the G20 Hamburg summit. The speculation (and investigations) are set to continue for a while yet.

The final thing to note is Trump’s failure to get the new health care bill passed. Two Republican Senators voted against the bill, which has cast doubt on the US President’s ability to deliver on the pledges and promises he made during the election campaign.

All of the political turmoil across the UK and US has had the effect of causing huge volatility in the US dollar and sterling. The main benefactor has been the euro, which has been performing remarkably consistently for some time now. It’s curious to see how the single currency has repeatedly benefited as a result of the weaknesses in the dollar and pound, as opposed to euro strength.

UK: Focus on Brexit negotiations

As it stands, Britain will be exiting the European Union by March 2019, but it’s fair to say that Brexit negotiations have hardly been inspiring up to this point. Theresa May’s failure to secure a mandate in the June 2017 UK general election has not helped matters; it appears the country is as divided about what stand the UK should take throughout the negotiations as it was about the decision to withdraw from the EU in the first place.

To make matters worse, there have been several reports of unrest in the cabinet and suggestions that Conservative MPs don’t want Theresa May to lead the Conservatives into the next election. The uncertainty in the UK at the moment is truly perplexing and, as far as Brexit negotiations go, make a difficult job even trickier.

A recent report by The UK in a Changing Europe, which brings together political, legal and economic experts, finds that exiting the EU without striking an agreement would create a political mess, a legal minefield and an economic disaster. The key message is that having no deal is something the UK must avoid at all costs. So it is with an element of alarm that the Secretary of State for International Trade, Liam Fox, has announced that the UK can ‘survive’ if it has to leave the EU with no deal. Where once it was about the UK leaving the EU to thrive, it’s now about doing its best to survive. The turmoil is set to continue long into next year.

Economic factors to watch in the UK

Brexit: In the last quarterly forecast we stated that it was impossible to view the Brexit negotiations without considering the forthcoming general election. Now that the election is over you would think the government could get on with the task of fresh negotiations. However, it hasn’t quite played out like that. The divisions within the Conservative Party seem to be increasingly fractious, while Boris Johnson has recently suggested that European leaders can ‘go whistle’ over EU divorce bill. With reports suggesting it could cost as much as £66 billion, it promises to be a sticking point in the near future and could stall talks.

Political instability: After the recent UK general election resulted in a hung parliament, Theresa May was forced to come to a ‘confidence and supply’ agreement with the Democratic Unionist Party. While the snap election was called to secure a mandate for a hard Brexit, the small majority May achieved shows the British public are divided on the best course of action. In addition, there is no guarantee May will get the support she needs if another general election is called. The uncertainty will lead to continuous sterling volatility for some time yet, with no real resolution in sight at the moment.

Inflation/interest rates/slowing wage growth: UK inflation dropped from 2.9% in May to 2.6% in June which surprised the markets. Talk of a possible interest rate rise had been steadily building in the weeks previous, but the drop in inflation will likely put paid to those ideas for the time being. It’s worth bearing in mind that 2.6% is still some way above the Bank of England’s target of 2%, so the situation is far from ideal. Another major concern is slowing wage growth, with the majority of Britons starting to feel the pinch and a drop in living standards. It’s currently a case of watching to see what happens, but the situation cannot continue and BoE might need to act before the year is out.

Europe: Focus on monetary policy

The euro has been making solid gains against both the pound and US dollar, in part because of their respective weaknesses rather than euro strength. Where the turn of the year saw a lot of uncertainty surrounding the political landscape, the defeat of Geert Wilders and Marine Le Pen in the Dutch and French elections respectively has led to a period of calm.

Indeed, since the election results, economic data for Europe improved. Inflation has moved back towards the European Central Bank’s target, eurozone Manufacturing purchasing managers’ index data is currently the highest it has been for six years, and growth continues at a healthy pace.

As a result of this positive data, there has been mounting speculation that the ECB is set to change its monetary policy. Comments from ECB President Mario Draghi and other central bank members have been taken as evidence by some that they are preparing for a change. If this goes ahead, it is likely to be in the form of tapering quantitative easing, at least initially.

Economic factors to watch in Europe

Interest rates: Throughout the last quarter there was speculation that the central bank might make alterations to interest rates. In June, the ECB sent a more hawkish signal to the markets, when it lifted its GDP growth forecast and declared that the eurozone deflation risk was over. However, when the ECB met on 20 July, the tone had become more dovish. Indeed, Draghi stated that any tightening of monetary policy would jeopardise recovery. However, inflation is still higher than the ECB wants it to be, so we cannot rule out an interest rate hike later this year.

Eurozone challenges: The recent political turmoil in the UK has given the EU the upper hand when it comes to Brexit negotiations, but that doesn’t necessarily mean it will all be plain sailing for the eurozone. Striking a deal is important to both sides, so movements in the single currency against the pound can be expected over the coming months. Whether it will strengthen or weaken is anybody’s guess, but it’s definitely something we’ll be keeping an eye on.

The Italian banking crisis continues to drag on, with some suggesting that this is the result of an unworkable policy regime imposed by EU authorities. While Italy initially wanted to nationalise Veneta Banco and Banca Popolare di Vicenza, the EU rejected the idea and instead rolled out an emergency plan that bails out senior bondholders and depositors above €100,000. Ultimately, this leaves Italian taxpayers to foot the bill.

Another concern is Grexit, where Greece could leave the euro. It’s a situation that has been overshadowed by other events recently, but it is a danger that continues to bubble under the surface. Definitely something worth keeping in mind for the foreseeable future.

US: Focus on Trump

One wonders how different Donald Trump’s Presidency would be were it not for Twitter. It seems with each passing day more controversy is courted. On 2 July, Trump sent out a Tweet which contained doctored footage in which he ‘body-slammed’ a character with the CNN logo for a head. It was just the latest in a series of communications that seem beneath someone in a position such as his.

The impact Trump’s behaviour is having on currency movements is difficult, if not impossible, to predict. For, while markets know which economic data is set for release – and can make informed predictions on what that data will show – nobody can anticipate exactly what the 45th President of the United States of America will Tweet from one day to the next.

But it’s not just Trump creating headlines. Trump Jr. recently Tweeted an email chain between himself and Rob Goldstone, a former tabloid reporter who said that he was writing on behalf of a mutual friend, Russian pop music star, Emin Agalarov. In the emails, Trump Jr. welcomed what he was told was a Russian government attempt to harm Hillary Clinton’s election campaign. Trump Jr. denied any wrongdoing, while Trump Sr. suggested that Clinton’s team would have taken the same opportunity had it presented itself – a viewpoint steeped in controversy as it appears to condone collusion between his team and the Russian government.

Trump’s recent failure to pass the new US health care bill are seen by many as a failure and it raises doubts surrounding his ability to deliver on the promises he made during his election campaign. As with the Brexit negotiations, this is something that is set to continue for some time yet.

Economic factors to watch in the US

Donald Trump: The Trump administration’s recent failure to get the US health care bill through the Senate has cast significant doubt on the 45th US President’s ability to deliver on the promises he made during his election campaign. This has caused unease in the markets and the dollar has been volatile for some time. With his regular Tweeting and family’s admission of contact with Russia during the election campaign, the Trump saga rolls on. It would be remiss to take your eyes off the situation for even a second.

Interest rates: In the past 18 months, the Federal Reserve has raised interest rates by 25 basis points three times. While earlier in the year the central bank confirmed it was prepared to increase the rates several times to keep a lid on inflation, the situation is now a little murkier. The question is whether the Fed should respond to loosening conditions and raise rates faster, or do they wait and see? The truth is nobody knows right now.

Geopolitical tensions: The US’s withdrawal from the Paris Agreement on 1 June 2017 shocked the world. While Trump said he was open to negotiating for a better deal, leaders of several countries stated that the terms were non-negotiable. The US’s standing in the world continues to tumble and the friction between the US and China has not yet been neutralised. North Korea’s ongoing missile testing is another thing to look out for, not least because it is a situation that could easily escalate rapidly.

*Reuters Smart Estimate by StarMine, a division of Thomson Reuters. We took a selection of forecasts to show the extremes. Accurate as of 20 July 2017.

About us

We are a recognised expert in international money transfers and provide UK companies with tailored currency exchange services. We help businesses mitigate risk and save money on international transfers and payments. This includes bespoke solutions to get competitive exchange rates on the day, reserve favourable rates for future purchase, or to secure upper and lower limits on rate purchases in advance. We are also passionate about educating businesses, and regularly provide news, insights and guides.

Much of this content first appeared in our quarterly currency forecasts update 2017 July – September. While some of it can be considered historical information we still believe it conveys an important message and is of some use to our audience.

Our latest quarterly currency forecasts are available to download now. They provide an overview of the last three months and look ahead to the rest of 2017.

020 7898 0500

020 7898 0500