The main aim of this report is to highlight how important currency risk management can be to businesses with foreign currency exposure, especially during these uncertain times.

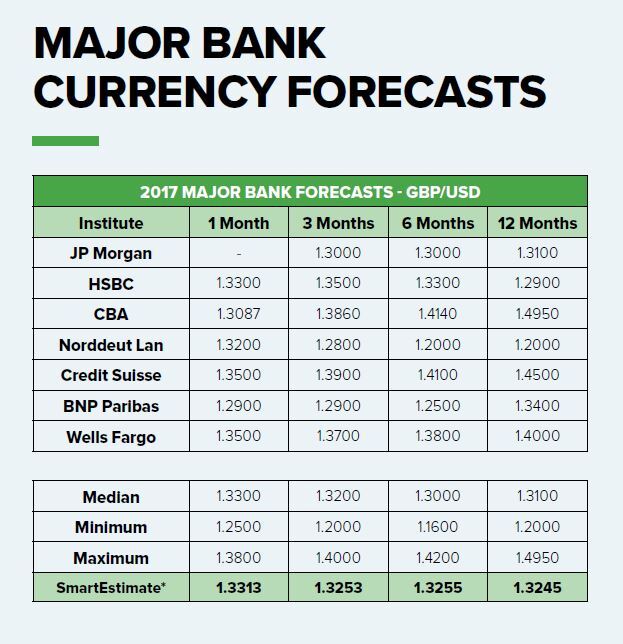

In our years of working in the foreign exchange industry, we have learned that, despite what anybody might claim, nobody knows what is going to happen to any given currency pairing from one day to the next. The sad truth is that there is no magic crystal ball to consult; we are often asked what is going to happen to the US dollar six months from now and we hold our hands up – we don’t know and neither does anyone else. Having said this, a currency forecast can prove useful in terms of understanding what economists think could happen.

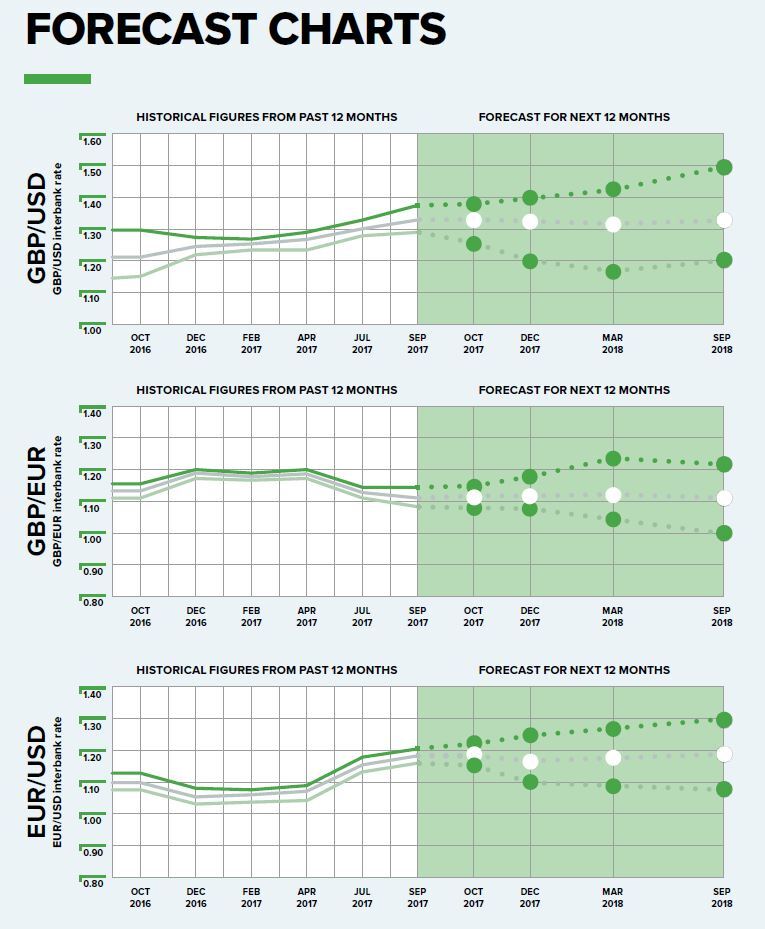

The forecast charts below show the disparities between the forecasted highs and lows from some of the most reputable banks in the world.

As you can see, there is no clear consensus and, truth be told, much of it is guesswork, albeit educated. Take the 2007-2008 financial crisis for example; with the exception of a handful of hedge fund managers, nobody recognised that the US subprime mortgage crisis was on the horizon until it was too late. Equally, who could have predicted that sterling would have weakened by 12 cents against the US dollar the day after Britain voted to withdraw from the European Union?

It might strike you as ironic that within this latest edition of our quarterly currency forecasts we are essentially telling you that forecasts aren’t worth the paper they are written on. However, while that is said with tongue firmly in cheek, it does help underline how dangerous forecasts can be if you make a decision based on them that turns out to be wrong.

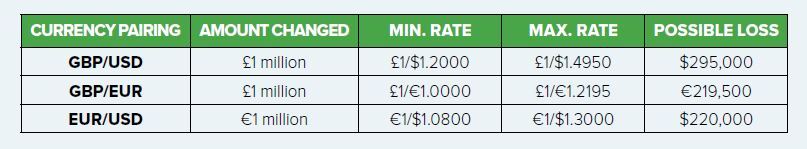

As experts in providing currency risk management consultations, we are necessarily passionate about producing informative and educational collateral that emphasises just how important currency risk management solutions can be. By way of one example, the minimum rate prediction for GBP/EUR over the next year is £1/€1.0000, while the maximum is £1/€1.2195. If you were exchanging £1 million, that discrepancy amounts to a potential loss of almost €220,000.

Hence our passion for communicating this crucial point: FX should never be seen as a revenue stream, but, if the right strategic approach is taken, it is a means of achieving a definite cash flow.

Summary of the third quarter of 2017

Given how eventful the first half of 2017 was, you could have been forgiven for thinking the second half would have been a more serene affair. However, the third quarter soon put paid to such notions, with economic and political uncertainty dominating the headlines on a near-daily basis.

UK Prime Minister Theresa May recently delivered a disastrous speech at the Conservative Party conference, during which she coughed and spluttered her way through, was handed a P45 by a ‘prankster’, and spoke about building a country that works for everyone as the lettering on the board behind her fell to the floor.

Then there is the lack of progress made so far in the Brexit negotiations. The fifth round of talks have commenced, but as the UK continues to stonewall over the exact cost of the exit bill, there is currently very little light at the end of what is proving to be an enormous tunnel. May recently stated that the Brexit ball was in the European Union’s court, but this was swiftly rebuked by the European Commission who said that Brexit negotiations are not a ball game and that there is still more work for Britain to do before any deal is struck.

Meanwhile, over the pond, US President Donald Trump continues to rattle the markets and society in general with his sporadic, highly unpredictable behaviour. There is also the Trump administration’s failure to pass the reforms promised in the run up to the election. His health care reforms have not been passed and neither have the tax reforms. He has, however, ordered a review of Dodd-Frank which was brought in to regulate financial institutions in the wake of the financial crisis of 2007-2008.

In Europe, there is the real possibility that Catalonia could become independent from the rest of Spain. There is huge support for and against independence which suggests that irrespective of the eventual outcome, the region is – and will continue to be – divided.

German Chancellor Angela Merkel’s failure to secure enough votes for an outright majority means that her Christian Democratic Union Party must form a coalition with other parties. Merkel has agreed to cap the number of refugees Germany accepts on an annual basis at 200,000 in a clear concession to the Christian Social Union Party that could enable Merkel to more easily form a coalition.

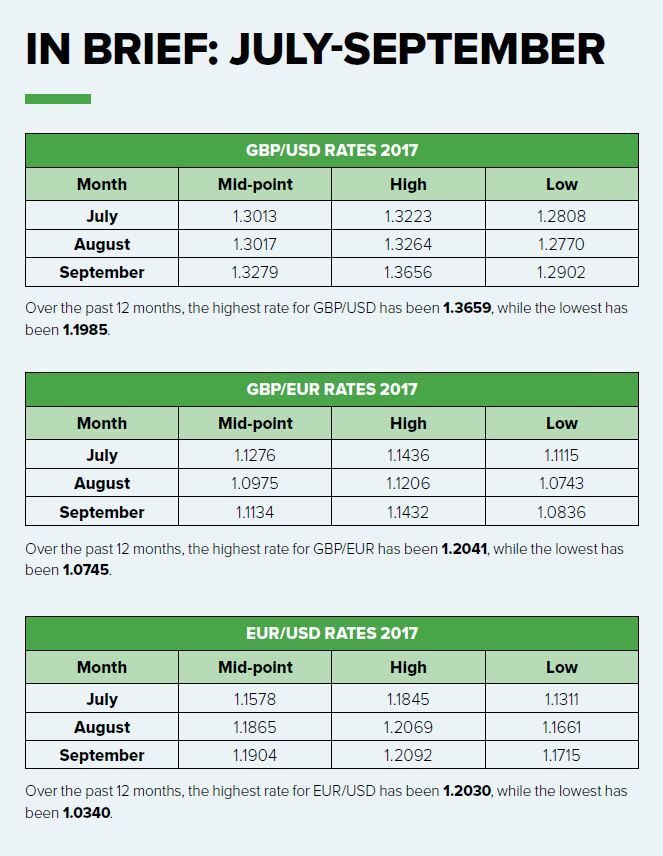

The past three months (and 2017 in general), have seen some huge currency volatility, especially to sterling and the US dollar. Much like the last quarter, the euro has been the most stable and consistent performer, although recent events across the eurozone could soon change that.

This report provides an overview of the events of the last three months, looks ahead to the next three months, and lists currency forecasts for sterling-US dollar, sterling-euro, and euro-US dollar.

UK: Focus on Brexit

The date at which the UK will withdraw from the European Union is fast approaching but the negotiations are only plodding along. Recently, the European Union’s Chief Negotiator, Michel Barnier said he felt the lack of progress was ‘very disturbing’. Perhaps more disturbing is that this comment was directly at odds with his British counterpart, David Davis, who insisted that talks have ‘come a long way’.

Of course, none of this bodes well for sterling, as the continued uncertainty is likely to cause huge volatility against a basket of other currencies. We are now in the fifth round of discussions and the UK government’s position still remains unclear. Reports that the UK and EU are trapped in a deadlock over the divorce bill will do nothing to placate the markets in the near future and neither will the fact that the EU insist that the terms of a future relationship cannot be agreed before the cost of withdrawal is.

The hope is that substantial progress will be made before the December summit of the European Council and Theresa May’s announcement that the UK will honour its financial commitments as a EU member is certainly a step forward.

However, details of future trade relations between the UK and EU are vital to UK businesses. It is imperative that some form of interim arrangement is established, otherwise the UK economy could be seriously damaged. The current frictionless trade we enjoy will vanish once the UK leaves the EU, so establishing favourable custom terms with the EU is important.

Economic factors to watch in the UK

Brexit: Another quarterly forecast, another allusion to Brexit. It’s the hot potato that we simply cannot drop right now; until more progress in the negotiations is made, we can expect sterling to experience volatility in the currency markets. A sliver of good Brexit-related news is often enough to strengthen the pound, but whenever a new round of talks begin, the contradictory comments coming from the EU and UK often send sterling sliding. In addition, there are divisions in the Conservative Party over whether the UK should aim for a soft or hard Brexit. A unified government would almost certainly speed up progress but we will have to wait and see whether that materialises in the near-future. However, it’s worth bearing in mind that it’s incumbent upon both sides to work out a deal and move away from posturing.

Interest rates/inflation/slowing wage growth: At the time of writing, current market pricing suggests there is almost a 90% chance that the Bank of England’s Monetary Policy Committee will increase UK interest rates by 25 basis points when they convene on 2 November 2017. Opinion is divided on whether this is the correct decision, not least because it will come from a position of relative weakness. However, inflation jumped to 3% in August from 2.9% in July which bolsters the case for raising rates. On the other hand, inflation continues to outpace wage growth and is leaving many British households feeling the pinch. The question is will rates be raised, or are hints of an increase an attempt to strengthen sterling?

The UK government: Tensions within the UK government appear to be on the rise following Theresa May’s disastrous Conservative Party Conference speech. Boris Johnson’s repeated attempts to undermine the Prime Minister are not doing her any favours either and there have been repeated calls for her to sack the Foreign Secretary. Meanwhile, various polls suggest that if another general election was held, the Labour Party would defeat the Conservatives. With the budget on the horizon, there is increased pressure on Philip Hammond to deliver policies that boost the Tory’s popularity. However, the weak economic data of late makes that task easier said than done.

Europe: Focus on the ECB

The euro has been remarkably consistent throughout 2017, making repeated gains against the US dollar and sterling. It has traded within a very tight range for weeks now and you do have to wonder how long the positive run can continue. It is common knowledge that the European Central Bank’s President, Mario Draghi, favours a weak euro for various reasons. A particularly important one is that a stronger euro makes it extremely difficult for the ECB to hit its 2% inflation target. In August, inflation increased its annualised rate to 1.5%, but core inflation remained at 1.2%.

However, the fact is that a strong euro is good for Europe. While the US dollar has been the global currency of choice for years, the euro’s performance since the turn of the year has been quite remarkable. Emmanuel Macron’s victory in the French Presidential elections and a consistently strong economy has seen the euro enjoy a prolonged period of stability. The increased prospect that the ECB will begin to taper its quantitative easing next year has also helped boost the euro and it will be interesting to see what Draghi and his colleagues do at the start of 2018.

At the meeting in September, the ECB announced that it would be keeping interest rates on hold and keeping their commitment to buy €60 billion of new bonds each month until at least the end of December 2017. However, if the euro continues its run, then there is only so long that Draghi can talk it down. He is famed for dovish sentiment, but there must surely come a time when he has to acknowledge that the euro is enjoying something of a renaissance. Whether he does that at the start of 2018 or delays the tapering until later is currently anybody’s guess.

Economic factors to watch in Europe

Monetary policy: ECB President Mario Draghi recently attended a press conference at the World Bank and International Monetary Fund annual meetings in which he said that the ECB has to be persistent with monetary policy. He said that inflation is currently too weak, perhaps because of poor wage growth and that the current asset-purchase programme – which expires in December – could continue next year. The ECB are set to meet on 26 October and it will be fascinating to see what they decide.

German coalition: As expected, Angela Merkel’s Christian Democratic Union (CDU) party won the recent German election. However, what wasn’t expected was the surge of support for the far-right Alternative für Deutschland party. Merkel’s failure to secure the outright majority she needed means that coalition talks between the Christian Social Union (CSU) party are ongoing. In an attempt to strike a deal, Merkel has agreed to cap the number of refugees Germany accepts at 200,000. Ultimately, this should enable her to form a coalition between the CDU, CSD, Greens and Free Democratic Party. However, the rise in support for a far-right party is still alarming.

Catalonia: In early October, Catalonia’s separatist government held a referendum on leaving Spain. This was in direct opposition to what the national authorities wanted and the Spanish leadership rejected the vote as illegal. However, on the day of the vote, videos of Spanish police repeatedly hitting unarmed Catalans were beamed around the world which helped bring the vote into the global consciousness. Organisers of the vote say that 90% of voters supported independence and Catalan President Carles Puigdemont signed the bill into local law soon after. However, the Spanish government has announced he failed to clarify whether he has declared independence. If he does, concerns over the divisions could bleed through to the currency markets and cause the euro to weaken.

US: Focus on Trump

In the last quarterly currency forecasts, the US focus was on Donald Trump and it should come as little surprise that it remains so for this quarter. Since the last edition, Trump has continued to court controversy with his statements and Tweets and he is still yet to implement any major policies. He recently claimed that the Affordable Healthcare Act – otherwise known as Obamacare – is dead, despite repeatedly failing to repeal the

legislation, and US publisher, Larry Flynt recently took out a full-page advert in the Washington Post Sunday promising a reward of up to $10 million for information leading to the downfall of the 45th US President.

Following Trump’s former Chief Strategist, Steve Bannon’s call for the metaphorical assassination of the Republican establishment that Mitch McConnell leads, Trump held a press conference outside the White House in which he insisted that he and McConnell were ‘closer than ever before’. However, this statement came just hours after Trump had told reporters that he understood where Bannon is coming from. Reports of divisions within the Trump administration continue apace and Trump’s frustration that he cannot push through his legislative agenda is becoming increasingly palpable.

Then there is the widespread skepticism surrounding the Trump administration’s claim that its proposed tax cuts would generate an additional $4,000 a year for the average US household. If true, this would represent a 5% increase in income for US families, which amounts to a staggering jump of $504 billion annually. Given that the non-negotiable elements of the proposed tax reforms include a cut in the corporate tax rate from 35% to 20%, it is difficult to see how the figures quoted would materialise. It is another proposed policy that is set to generate considerable controversy, irrespective of whether Trump manages to get it through.

Economic factors to watch in the US

Donald Trump: It is now ten months since Donald Trump became the 45th President of the United States and his tenure has been controversial to say the least. His Tweets continue to reverberate around the world and it appears not a day goes by without him picking a fight with someone or other. In addition, it has been a month since Hurricane Maria hit Puerto Rico and officials say that more than 80% of people still don’t have electricity, but Trump’s response has been to say that the island’s residents ‘want everything done for them’, threaten to remove FEMA’s help, and boast that ‘nobody could have done what I’ve done with so little appreciation’. His behaviour continues to be unbecoming of someone in his position.

Interest rates: The majority of economists expect the Federal Reserve to increase interest rates in December. Indeed, at the time of writing, expectations of another US rate increase before the year is out have increased to around 90% from around 50% just one month ago. Fed Chair Janet Yellen recently spoke at a news conference in which she hinted that the central bank will resume raising rates in acknowledgement of a strengthening economy. While there has been a recent slump, this can largely be attributed to the recent spate of hurricanes and it is expected the economy will pick up again once the dust has settled.

Geopolitical tensions: The tensions between the US and North Korea have died down a little of late, although any relief that came from this was always likely to be temporary. And so it proved, as North Korea’s Deputy United Nations Ambassador, Kim In Ryong recently told the UN General Assembly’s disarmament committee that “the entire US mainland is within our firing range and if the US dares to invade our sacred territory even an inch it will not escape our severe punishment in any part of the globe.” Threats such as these have been a permanent fixture of Kim Jong-un’s reign, but the question really is how will Trump respond?

Currency forecast charts

*Reuters Smart Estimate by StarMine, a division of Thomson Reuters. We took a selection of forecasts to show the extremes. Accurate as of 9 October 2017.

Resources

Forward Contract Widget

Forward contracts enable you to reserve a price for buying or selling currencies on a specific date in the future. The price you lock in is determined on the day you agree the amount and settlement date for the forward contract. Forward contracts are particularly useful for businesses that have future payments or receipts in foreign currency because they allow you to protect your budget and profit margins. They can be an important part of a company’s hedging toolkit because they remove any concerns over the unpredictability of currency markets, enabling you to focus on running your business.

We have created a forward contract widget to help you identify the currency risks you could have exposed your business to by using spot contracts rather than forward contracts over the last 12 months.

Treasury Management White Paper

We have recently written a Treasury Management White Paper to help our clients understand how important currency risk management can be. We understand how difficult running a business can be, so seeing the forecasted profit margins – gross and net – being eroded by exchange rate volatility would be extremely frustrating, especially if the currency risk is manageable.

Daily Currency News

As part of our ongoing commitment to producing collateral that is useful to our audience, we have a currency note that gets sent out every Monday, Tuesday, Wednesday, Thursday and Friday. It gives a round-up of the previous day’s market events, as well as some of the political and economic events to look out for throughout the week. It is free to register and you can unsubscribe any time you like.

Business Services

As well as being experts in international money transfers, we provide a range of different business services that can be tailored to suit your business’s specific requirements. We offer effective treasury management services, several hedging products, and methods for accelerating business growth. If you want to find out more about the services we offer, then please do not hesitate to get in touch.

About us

We create tailored treasury management solutions to protect our clients’ profits and help them realise their business growth ambitions. Importantly, we work closely with our clients to understand their budget and the associated risks. Once an understanding has been established, we work to provide effective solutions that afford peace of mind.

We are also passionate about helping our clients understand just how important currency risk management can be in these uncertain times, and regularly provide news, insights, guides and white papers to educate businesses.

Much of this content first appeared in our quarterly currency forecasts update 2017 October – December. While some of it can be considered historical information we still believe it conveys an important message and is of some use to our audience. To download a copy of our most recent forecasts simply visit the relevant page, enter your details and your free download will begin.

020 7898 0500

020 7898 0500