The main aim of this report is to highlight how important currency risk management can be to businesses with foreign currency exposure.

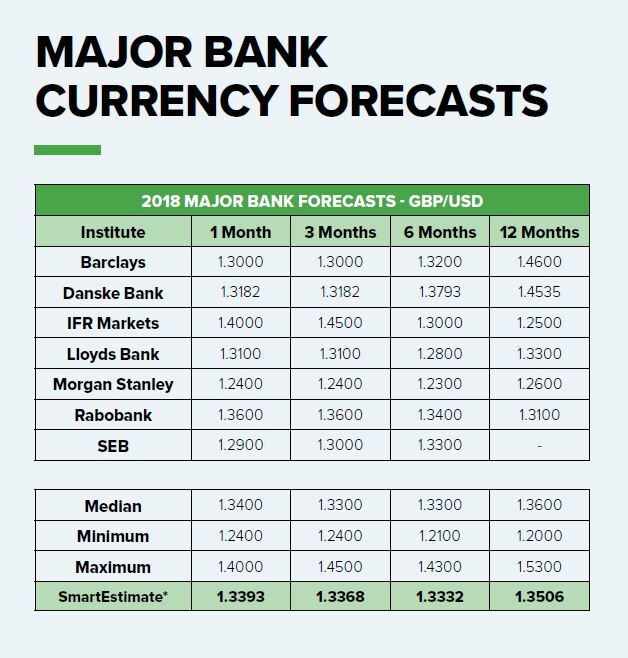

In our years of working in the foreign exchange industry, we have learned that despite what anybody might claim, nobody knows what is going to happen to any given currency pairing from one day to the next. The sad truth is that there is no magic crystal ball to consult; we are often asked what is going to happen to the US dollar six months from now and we hold our hands up – we don’t know and neither does anyone else. Forecasts can prove useful indicators for what economists and analysts believe is going to happen, but they should only be thought of as guides with no guarantee of accuracy.

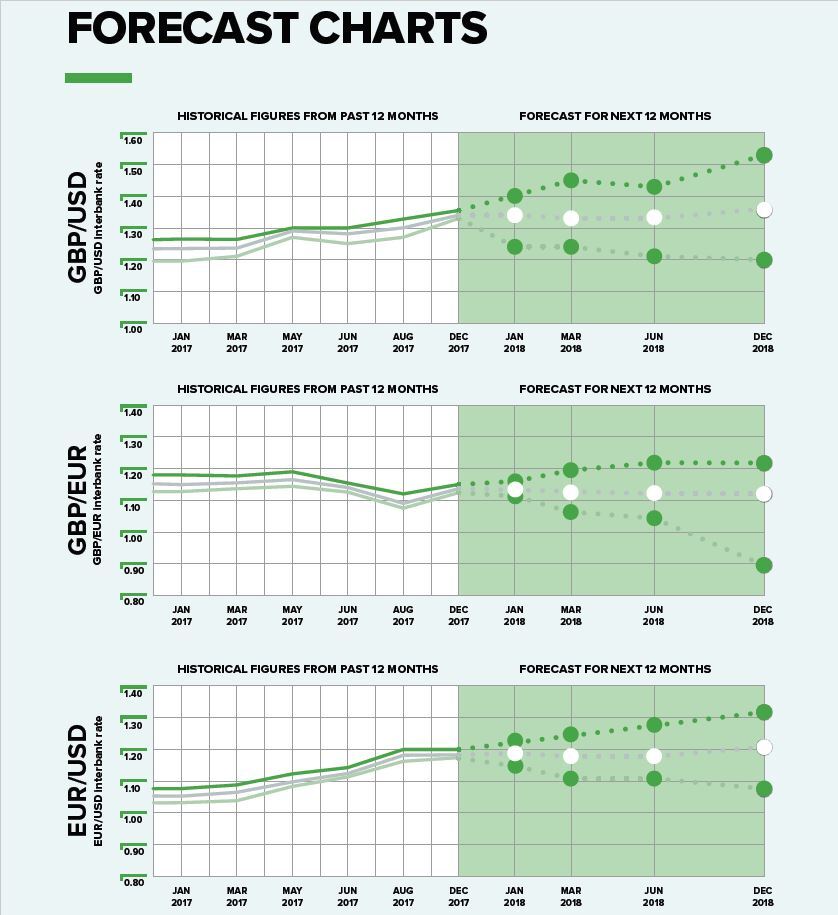

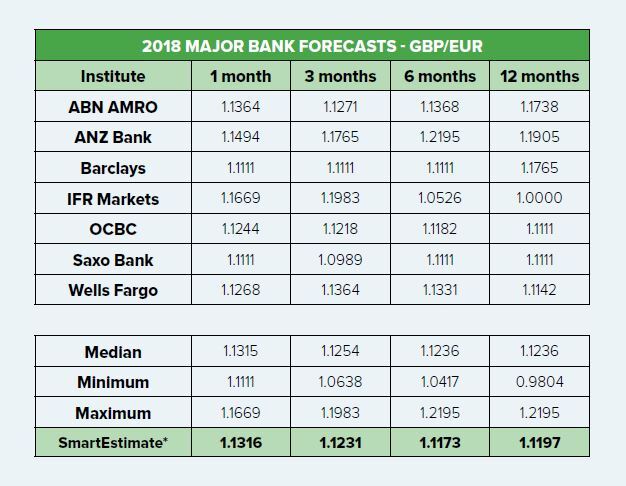

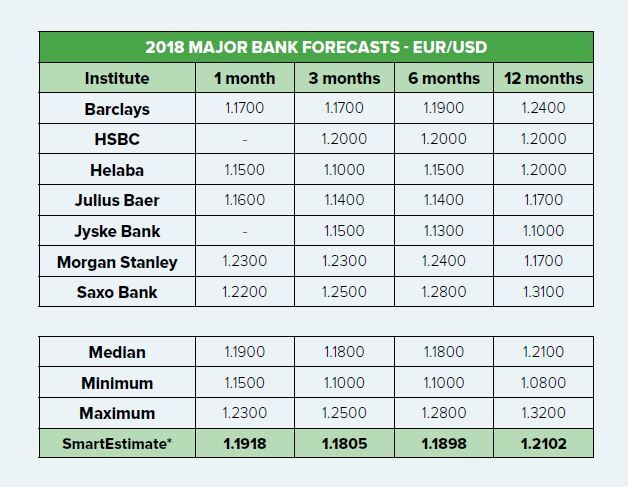

The forecast charts below show the historical figures from the past 12 months and what the forecasted highs, lows and averages are for the next 12 months.

From the above it is clear that nobody is agreed on what is going to happen from one month to the next.

It might strike you as ironic that within this edition of our quarterly currency forecasts we are essentially telling you that forecasts aren’t worth the paper they are written on. However, while that is said with tongue firmly in cheek, it does help underline how dangerous forecasts can be if you make a decision based on them that turns out to be wrong.

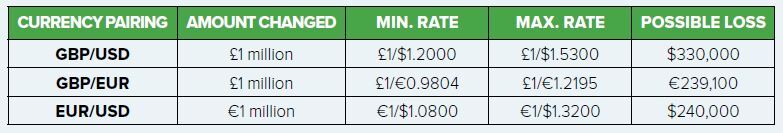

As experts in providing currency risk management consultations, we are necessarily passionate about producing informative and educational collateral that emphasises just how important currency risk management solutions can be. By way of one example, the minimum rate prediction for GBP/EUR over the next year is £1/€0.9804, while the maximum is £1/€1.2195. If you were exchanging £1 million, that discrepancy amounts to a potential loss of almost €240,000.

Hence our passion for communicating this crucial point: FX should never be seen as a revenue stream, but, if the right strategic approach is taken, it is a means of achieving a definite cash flow.

Summary of 2017

2017, eh? What. A. Year. The Year of the Alternative Fact. The Year of the Hung Parliament. The Year of the Trump. The Year of the Brexit Uncertainty. The Year of the Rise in Populism. In short, The Year of the Rollercoaster.

It appeared that not a day went by without fresh political and/or economic uncertainty. 2017 kicked off with the January inauguration of Donald Trump who proceeded to deliver the shortest inaugural address since Jimmy Carter’s in 1977. Still, the nationalist and populist tone he struck was a fitting beginning to the year.

In February, North Korea fired a missile across the Sea of Japan which sparked international outrage and condemnation. Then in March, the United Kingdom triggered article 50 of the Lisbon Treaty which signalled the beginning of Brexit negotiations.

The US announced its decision to withdraw from the Paris Climate Agreement in June – a decision which drew criticism from other nations around the world. It seemed symptomatic of Trump’s view that the US is being ‘taken for a ride’ by other countries. One wonders how much further the US can retreat from the international community and what effect this will have on its global influence.

June was also the month that the UK held a surprise snap election, which resulted in a hung parliament. UK Prime Minister Theresa May had been hoping to secure a mandate for her vision of Brexit, but it wasn’t to be and the Conservatives suffered the indignity of entering a confidence-and-supply deal with the Northern Irish Democratic Unionist Party.

In August, Hurricane Harvey wreaked havoc across Houston and it eventually became the costliest natural disaster in United States history. This was followed by Hurricane Irma which swept across the US and the Caribbean in September, and two weeks later Hurricane Maria struck Dominica and Puerto Rico.

The US announced its decision to withdraw from UNESCO in October and later that same month, Catalonia declared independence from Spain. German Chancellor Angela Merkel also officially announced that she would be inviting the Free Democrats and the Greens to discuss forming a coalition following the German federal election in September. However, talks collapsed in November and it remains to be seen when a new coalition government will be formed and which parties will be involved.

UK – Focus on Brexit

It is the start of a new year, but it is the same old story regarding the UK’s focus for the coming months. Towards the end of last year there was evidence of some progress, as European Commission President Jean-Claude Juncker and UK Prime Minister Theresa May confirmed that phase two of the Brexit talks will begin before too long.

However, nothing is that straightforward when it comes to Brexit, which perhaps best explains why there is still some confusion on when these talks will commence. May insisted they would begin immediately, but Juncker said they would begin in March 2018. Still, progress is progress and confirmation of reaching the next stage was welcome on both sides of the English Channel.

The key dates to look out for in the next three months are March 22-23. That is when the European Council summit takes place in Brussels and it should provide us with an opportunity to assess what sort of future trade deal between the UK and EU can be expected.

It will not be until October 2018 that a final treaty on withdrawal and transition can reasonably be expected to be ready. It is at this point that the EU’s Chief Negotiator Michel Barnier says a real negotiation on a free trade deal can begin. Unfortunately, that will only give us four or five months to conclude a deal before we exit the EU.

Economic factors to watch in the UK

Brexit: In almost all of the collateral we produce, we are keen to impress upon our audience just how volatile the currency markets can be and how unpredictable the movements between any given currency pairing can be. Brexit exemplifies this like no other issue at present; when we learned that phase two of the Brexit talks will begin soon, sterling still weakened against the euro and dollar. One would have expected the markets to have been encouraged by this sign of progress but, for whatever reason, it didn’t work out that way. At least in the short-term anyway. It is one thing to be unable to predict whether Brexit-related news will be positive or negative, but entirely another when positive news for the UK doesn’t necessarily point to sterling strengthening.

The UK economy: A raft of economic data released early in 2018 suggests that the UK economy ended 2017 on a positive note. Manufacturing, construction and services purchasing managers’ index figures all came in above 50.0 which shows that there are signs that the UK economy is just about managing to hold its own. Indeed, Britain’s services sector in particular grew faster than expected and the final quarter of 2017 looks set to be the UK’s strongest. Having said this, there are persistent concerns over the challenges associated with Brexit, with many UK businesses demanding clarification on the direction Brexit will take.

Interest rates/inflation/slowing wage growth: The Bank of England’s Monetary Policy Committee decided to increase interest rates by 25 basis points to 0.5% on 2 November 2017. Opinion was divided on whether this was the correct decision and it remains to be seen whether it was. The fact is that inflation continues to outpace wage growth and UK households have felt the pinch throughout 2017. Given that inflation was more than a percentage point above BoE’s target of 2%, Governor Mark Carney had to write a letter to Chancellor Philip Hammond to explain why – and BoE had to be seen to be doing something to curb inflation. It is hoped that increasing interest rates will have the desired effect and the gap between inflation and wage growth will narrow over the coming months.

Europe – Focus on the ECB

One of the key things to look out for in 2018 is the European Central Bank’s pursuing of monetary policy-normalisation. The European economy proved resilient throughout 2017 and the economic recovery continues apace.

This strength and resilience was acknowledged by the ECB when its members met in October. Soon after, it was announced that it would be halving its monthly asset purchases from €60 billion to €30 billion beginning in January 2018. President Mario Draghi confirmed that this would be the case until at least September 2018 and could even be extended beyond that.

However, normalisation of monetary policy is something that will occur throughout 2018 and beyond – it is really a question of how dramatic the normalisation will be. It is worth noting that it is not immediately clear precisely why normalisation is being undertaken. Inflation remains below the ECB’s 2% target and, while German unemployment is at its lowest level since reunification, unemployment across the eurozone is less impressive.

Perhaps the ECB’s reticence is an attempt to avoid a self-fulfilling prophecy; if they allude to the factors they are trying to combat with their policy-normalisation then they could be brought to bear. The reduction of the ECB’s quantitative easing programme was to be expected given the eurozone’s economic recovery, but the rate at which it reduces and the finer details could prove crucial.

Economic factors to watch in Europe

German coalition: In September, German Chancellor Angela Merkel suffered a setback when her Christian Democratic Union party failed to win the German federal election. The Christian democratic political alliance that she leads won 33% of the vote which was a drop of more than 8%. Worryingly, the far-right Alternative for Germany party secured 12.6% of the vote. Since then, an attempt to form a coalition government broke down and the question is whether Merkel will succeed in a second attempt. As the eurozone’s largest economy, it is important for a stable government to be formed sooner rather than later, though it is expected that talks will last until at least March. Merkel recently began fresh talks with the Social Democrats and, while fresh talks are a step in the right direction, there is no guarantee an arrangement will be reached.

Italian general election: On 28 December 2017, President Sergio Mattarella dissolved the Italian Parliament to make way for the 2018 Italian general election. It is due to be held on 4 March 2018 and it will be fascinating to see which, if any, party will prevail. In 2013, none of the three main parties won an outright majority and the forthcoming election represents the next major political test for the European Union. As it stands, it is highly possible that the victor will struggle to secure a majority which would result in a hung parliament. If this proves to be the case, the resultant uncertainty could take a toll on the euro.

Political uncertainty: 2017 was a year of relative political instability for the eurozone and there was a clear rise in populism across Europe. While Geert Wilders and Marine Le Pen were both ultimately defeated, the fact that they were even in with a chance was a cause for consternation. 2018 looks set to be a slightly more calming affair, but the Italian election is difficult to call and towards the end of last year, Austria became the only country in western Europe with a far-right presence in government. The Catalonian crisis is yet to be completely quelled and a pro-independence government looks likely to be reappointed – something to watch closely over the coming months.

US – Focus on Trump

The last two quarterly currency forecasts we have produced have had the 45th President of the United States as the focus. The fact is it is difficult to see how the main focus of attention could rest anywhere other than on Donald Trump while he remains the most powerful human being in the world.

Towards the end of 2017, Trump secured his first major legislative victory, with the passing of his tax reforms – a move that was heavily criticised for favouring the richest members of US society. Then there is the ongoing saga relating to collusion with Russia throughout the 2016 election campaign.

The recent publication of Michael Wolff’s Fire and Fury has raised the question of whether Trump is fit to serve as President and there is speculation that his staff have little faith in his ability. Whether anything happens as a result of this remains to be seen, but Trump’s recent claim that he is, like, really smart served to highlight just how unprecedented the times we currently find ourselves in are.

The fact is that, unless something truly remarkable happens, then Trump will be the President of the United States for the foreseeable future. What he does in that time is anybody’s guess and, as we have already learned, his unpredictability is really the only thing we can predict.

Economic factors to watch in the US

Donald Trump: Since Trump became President, the US economy has undergone something of a boom. Unemployment is at its lowest point for 17 years, the stock market is booming, and GDP growth is healthy. However, there is still debate on just how much credit Trump can take for this. His recent tax reforms did not boost the value of the dollar as much as some quarters expected, and it should be noted that job gains are still below the average we saw during Barack Obama’s reign. The question really, is whether any further legislative changes will take place this year and, if so, what impact they will have on the economy.

Federal Reserve: As expected, the Federal Reserve increased interest rates in December. There was very little dollar strengthening in the aftermath of the decision, not least because the hike had already largely been priced in to the market. After the meeting, Fed Chair Janet Yellen suggested that the policy outlook for 2018 and beyond would remain unchanged. However, Jerome Powell is set to replace Yellen this year and, as the first Fed Chair without an economics degree for 30 years, it will be interesting to see what he says in the coming months.

GDP growth: In 2017, Trump stated that the US economy will grow by 3% in 2018 and, while economists had previously stated that they expected it to grow at 2.6%, that was before the tax cuts were signed into law. Still, even if the 2.6% is shown to be the case, it would represent a marked improvement from the 2.3% growth originally projected in 2017. As it stands, it is possible that Trump’s promise could become reality.

Currency forecast charts

*Reuters Smart Estimate by StarMine, a division of Thomson Reuters. We took a selection of forecasts to show the extremes. Accurate as of 9 January 2018.

Resources

Forward Contract Widget

Forward contracts enable you to reserve a price for buying or selling currencies on a specific date in the future. The price you lock in is determined on the day you agree the amount and settlement date for the forward contract. Forward contracts are particularly useful for businesses that have future payments or receipts in foreign currency because they allow you to protect your budget and profit margins. They can be an important part of a company’s hedging toolkit because they remove any concerns over the unpredictability of currency markets, enabling you to focus on running your business.

We have created a forward contract widget to help you identify the currency risks you could have exposed your business to by using spot contracts rather than forward contracts over the last 12 months.

Treasury Management White Paper

We have recently written a Treasury Management White Paper to help our clients understand how important currency risk management can be. We understand how difficult running a business can be, so seeing the forecasted profit margins – gross and net – being eroded by exchange rate volatility would be extremely frustrating, especially if the currency risk is manageable.

Daily Currency News

As part of our ongoing commitment to producing collateral that is useful to our audience, we have a currency note that gets sent out every Monday, Tuesday, Wednesday, Thursday and Friday. It gives a round-up of the previous day’s market events, as well as some of the political and economic events to look out for throughout the week. It is free to register and you can unsubscribe any time you like.

Business Services

As well as being experts in international money transfers, we provide a range of different business services that can be tailored to suit your business’s specific requirements. We offer effective treasury management services, several hedging products, and methods for accelerating business growth. If you want to find out more about the services we offer, then please do not hesitate to get in touch.

About us

We create tailored treasury management solutions to protect our clients’ profits and help them realise their business growth ambitions. Importantly, we work closely with our clients to understand their budget and the associated risks. Once an understanding has been established, we work to provide effective solutions that afford peace of mind.

We are also passionate about helping our clients understand just how important currency risk management can be in these uncertain times, and regularly provide news, insights, guides and white papers to educate businesses.

Much of this content first appeared in our quarterly currency forecasts update 2018 January – March. While some of it can be considered historical information we still believe it conveys an important message and is of some use to our audience. To download a copy of our most recent forecasts simply visit the relevant page, enter your details and your free download will begin.

020 7898 0500

020 7898 0500