In our Quarterly Forecast document, we explain that the currency predictions from the major banks are little more than guesswork. But how do the latest forecasts fare against actual exchange rates?

Predictions

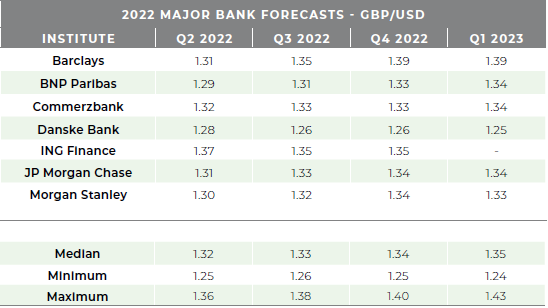

The table below details bank predictions for GBP/USD over the coming quarters. The minimum prediction for GBP/USD for the second quarter of this year was $1.25.

Source: Bloomberg

Reality

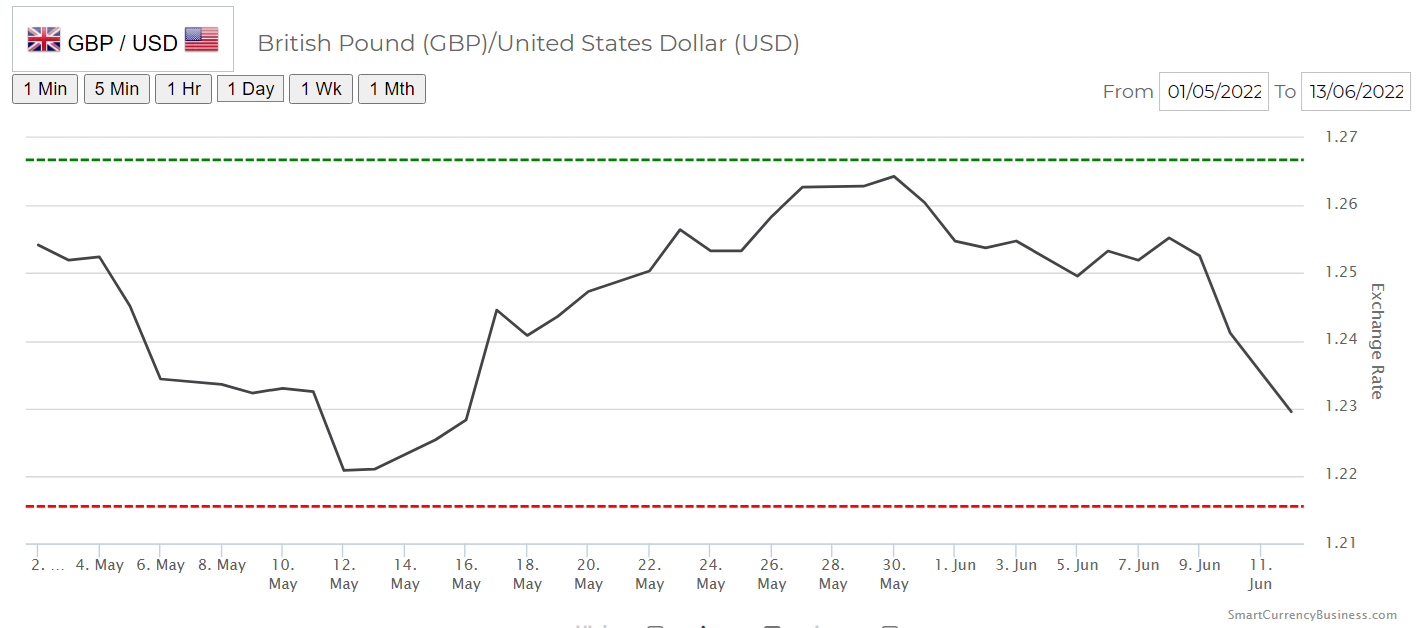

Just over a month after these predictions were published, the reality was very different. GBP/USD has already fallen below the minimum prediction and stood below $1.22 at the beginning of May 2022 – a low that hasn’t been seen since May 2020.

In June, sterling then slipped back near 2-year lows, to $1.21, following poor UK economic data and high US inflation.

GBP/USD May-June 22

A threat of parity for GBP/USD?

Will GBP/USD dip below $1.20 or lower? Since 1985, the pound has only dipped below this level during Brexit instability and in the first days of the pandemic. So, what could weaken this pairing further?

Damaging for the pound:

- High inflation and weak economic growth in the UK and abroad

- The market view that the Bank of England will not be able to hike rates many more times without causing a recession

Supportive for the dollar:

- Federal Reserve’s aggressive stance toward monetary policy and interest rates

- Concerns about the global economy boosts dollar’s safe-haven appeal

What does this mean for businesses?

The above depicts just one example of when bank forecasts were wildly incorrect. For businesses that import and export, the disparity between bank predictions and actual exchange rates shows that decisions should never be based on currency forecasts.

The inaccuracy of these forecasts and the uncertainty that lies ahead proves that it has never been more vital to be proactive about currency risk management.

To discuss how we can help you to manage your currency risk effectively, please contact us on 020 7898 0500 or email [email protected].

020 7898 0500

020 7898 0500