A Guide to the 2020 US Election

The Presidential Election took place on the 3rd of November. After two contentious debates and a surge in early voting, it’s shaping up to be a very interesting election, to say the least. Votes continue to be counted across the country.

In this guide, we take you through the key moments to look out for, how currencies could be impacted and what you can do to protect your business from currency fluctuations.

How could currency pairs react?

Our view of the possible market reactions:

Biden Win

Trump Win

![]()

![]()

GBP/USD

Could strengthen if Biden pursues corporate tax plan, financial re-regulation, tougher restrictions on oil from shale and minimum-wage hikes. Biden will adopt a less Brexit friendly approach which could trim potential gains.

![]()

![]()

GBP/USD

Weaker if Trump’s aggressive trade protectionism continues, but not drastically lower as Trump will have a friendlier view on UK/US trade deal.

![]()

![]()

EUR/USD

Could strengthen if Biden pursues corporate tax plan, financial re-regulation, tougher restrictions on oil from shale and minimum-wage hikes. EUR also to benefit as alternative reserve currency if inflationary policies adopted by via deficit spending.

![]()

![]()

EUR/USD

Lower on renewed trade tensions and continued de-regulation as well as America first programme.

![]()

![]()

GBP/EUR

Muted movement, but EUR could benefit on a less friendly Brexit stance.

![]()

![]()

GBP/EUR

Muted movement, but GBP could benefit on a friendlier Brexit stance.

Stock Markets

Mostly priced in, but corporate tax plan could work against equities, only offset by a generous spending programme affecting lower income households.

Stock Markets

This could be a repeat of 2017 rally as Trump is committed to re-opening the economy at a faster pace. Release of Covid-19 vaccine will be accelerated as Trump has promised this before year end.

How could currency pairs react?

Our view of the possible market reactions:

Biden Win

![]()

![]()

GBP/USD

Could strengthen if Biden pursues corporate tax plan, financial re-regulation, tougher restrictions on oil from shale and minimum-wage hikes. Biden will adopt a less Brexit friendly approach which could trim potential gains.

![]()

![]()

EUR/USD

Could strengthen if Biden pursues corporate tax plan, financial re-regulation, tougher restrictions on oil from shale and minimum-wage hikes. EUR also to benefit as alternative reserve currency if inflationary policies adopted by via deficit spending.

![]()

![]()

GBP/EUR

Muted movement, but EUR could benefit on a less friendly Brexit stance.

Stock Markets

Mostly priced in, but corporate tax plan could work against equities, only offset by a generous spending programme affecting lower income households.

Trump Win

![]()

![]()

GBP/USD

Weaker if Trump’s aggressive trade protectionism continues, but not drastically lower as Trump will have a friendlier view on UK/US trade deal.

![]()

![]()

EUR/USD

Lower on renewed trade tensions and continued de-regulation as well as America first programme.

![]()

![]()

GBP/EUR

Muted movement, but GBP could benefit on a friendlier Brexit stance.

Stock Markets

This could be a repeat of 2017 rally as Trump is committed to re-opening the economy at a faster pace. Release of Covid-19 vaccine will be accelerated as Trump has promised this before year end.

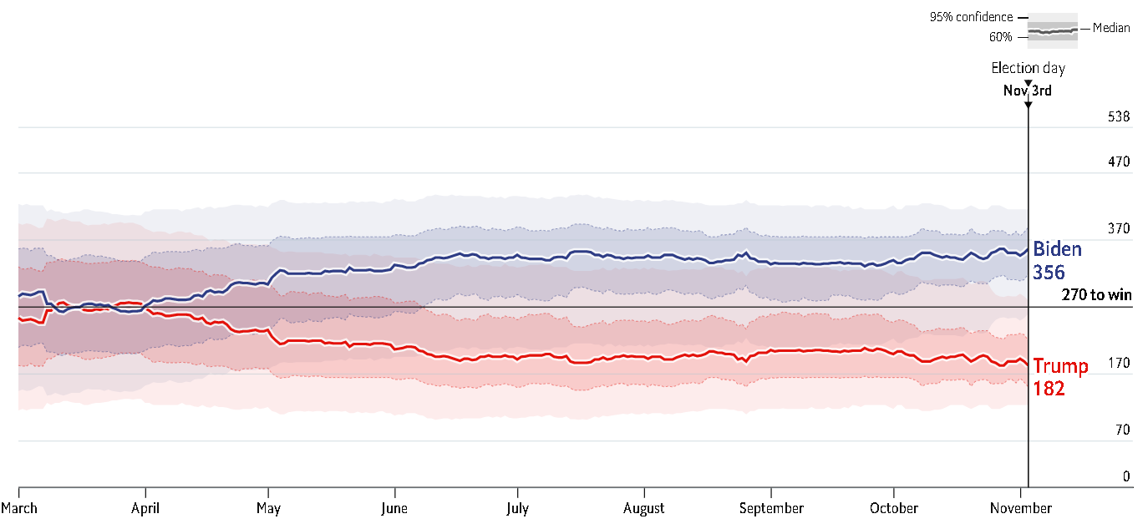

Estimated Electoral College votes

This chart from The Economist now points to a 95% likelihood of a Biden win as of 03.11.20. However, we know from the previous election that the result could still go either way.

Source: https://projects.economist.com/us-2020-forecast/president

Election Timeline

We’ve outlined key timings for the election day and subsequent events.

November 3 (Election Day):

We focus on closing poll times for key contested (‘swing’) states.

- Polling hours (all times given are in Eastern Standard Time(EST), or GMT−05:00):

- 6:00 a.m. to 12:00 p.m. (GMT 11:00-17:00): Polls open across the 50 states.

- 7:00 p.m. (GMT 00:00): Polls close in the Eastern Time Zone sections of Florida

- 7:30 p.m. (GMT 00:30): Polls close in North Carolina, Ohio, and West Virginia

- 8:00 p.m. (GMT 1:00): Polls close in the Eastern Time Zone sections of Michigan, the Central Time Zone sections of Florida and Pennsylvania

- 9:00 p.m. (GMT 2:00): Polls close in the Central Time Zone sections of Michigan and all of Arizona, Minnesota, Wisconsin, and Wyoming

- 11:00 p.m. (GMT 4:00): As per the long-standing agreement, this is the earliest that the media can declare if there is a President and Vice President-elect.

November 4:

- 9:00 a.m. (GMT 14:00): Counting of absentee/mail-in ballots begins in many states.

December 2020

- December 8: The “safe harbor” deadline under the Electoral Count Act, where states must finally resolve any controversies over the selection of their electors of the Electoral College.

- December 14: The electors meet in their respective state capitals(electors for the District of Columbia meet within the district) to formally vote for the president and vice president.

Why Smart Currency Business, for your business?

- Manage your currency risk with our fast, secure and reliable services

- Our experts will guide you every step of the way

- We won’t charge any commission or transfer fees

- Your funds are held securely in segregated accounts

- We are authorised by the Financial Conduct Authority (FCA)

Fill in this quote form and discuss your requirements with us

Disclaimer:

Option contracts are offered by Smart Currency Options Limited (SCOL) on an execution-only basis. This means that you must decide if you wish to obtain such a contract, and SCOL will not offer you advice about these contracts.

This material provides you with generic and illustrative information and in no way can it be deemed to be financial, investment, tax, legal or other professional advice, a personal recommendation or an offer to enter into an option contract and it should not be relied upon as such. Any changes in exchange rates and interest rates may have an adverse effect on the value, price or structure of these instruments.

SCOL shall not be responsible for any loss arising from entering into an option contract based on this material. SCOL makes every reasonable effort to ensure that this information is accurate and complete but assumes no responsibility for and gives no warranty with regard to the same.

Foreign exchange options can carry a high degree of risk and are not suitable for everyone as they can have a negative impact on your capital. If you are in doubt as to the suitability of any foreign exchange product, SCOL strongly encourages you to seek independent advice from suitable financial advisers.

Consulting a website or receiving a publication does not constitute a customer relationship and SCOL shall not have any duty or incur any liability or responsibility towards any person or entity as a result thereof.

SCOL is a wholly-owned subsidiary of Smart Currency Exchange Limited, and is authorised and regulated by the Financial Conduct Authority to carry out MiFID business with reference number 656427.

SCOL is a private company limited by shares registered in England and Wales. Company number 9034947. The registered office address is at 1 Lyric Square, Hammersmith, London W6 0NB.

020 7898 0500

020 7898 0500