Quarterly Forecast July-September 2025

Read moreThe Race Against Time

Will Sterling stabilise before global threats arrive?

NOTE FROM THE MANAGING DIRECTOR

The world is changing fast these days. As the months fly by, it’s getting increasingly difficult to condense every major event into a snappy report. But that’s what we’ve done – not without a few sleepless nights. There’s no shortage of drama in these pages, that’s for sure.

At the time of our last forecast, economists were issuing dire warnings about the global implications of American trade policy. Thankfully, the world has averted a full-scale financial meltdown. We now know that Donald Trump (or a quorum of his closest advisors, at least) can be persuaded to change course. “Liberation Day” sent markets into a tailspin. But the president relented multiple times and his bark on tariffs has so far proved worse than his bite.

The relentless flow of major news stories – the threat of tariffs, of war, of “Black Swan” events lurking beneath the surface – mean there is no sense in leaving your budget in the hands of fate. The old saying “buy in May and go away” doesn’t work in the era we’re living through.

As a 20-plus-year veteran of the financial world, we know the opposite to be true. Businesses require careful, ongoing management of their currency exposures, founded on a strategy focused enough to deliver on your objectives but malleable enough to overcome new

challenges. Smart Currency Business is committed to providing the comprehensive support that you won’t find elsewhere.

As ever, we hope you find our report of use in the months ahead. Here’s to another productive summer working side by side.

HOW DID Q2 FORECASTS FARE AGAINST REALITY?

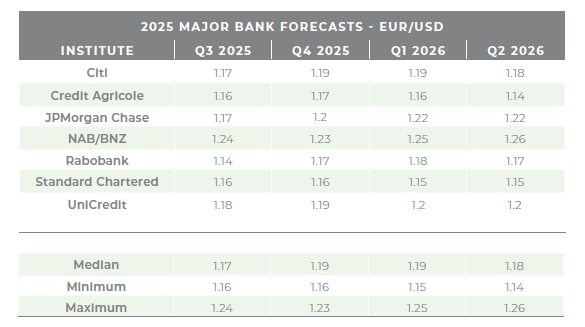

The bank forecasts we included in our previous report were largely made before 2 April, which helps explains how completely wide of the mark they proved.

The euro, predicted to struggle hugely, was the surprise overperformer of the past three months. The US dollar meanwhile experienced a dramatic reputational loss, even if that may take several years to fully feed through into relative value pricing. Over these past three months, the pound and the euro have each strengthened by close to ten cents against the US dollar. But sterling is not out of the woods yet. As the outlook for the eurozone improves on the promise of investment, the pound has been hamstrung by a sense of drift in the UK economy.

GBP/USD

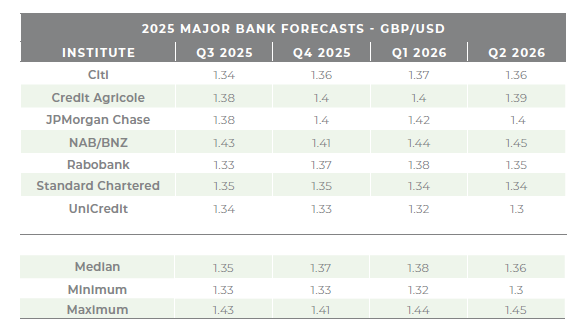

A 10-cent chasm separates where GBP/USD started April and ended June. Since the ice bath shock that was Liberation Day, sterling has strengthened against the US dollar to levels not seen since the end of 2021, neatly summarising a truly dismal quarter for the US dollar.

Even such a one-sided quarter was not without its hiccups. As we’ll see below, the dynamics that influenced GBP/USD were very much dollar weakness as opposed to sterling strength. That didn’t stop sterling from smashing past the 1.32 ceiling predicted in our last forecast and entering July on the cusp of 1.38.

GBP/EUR

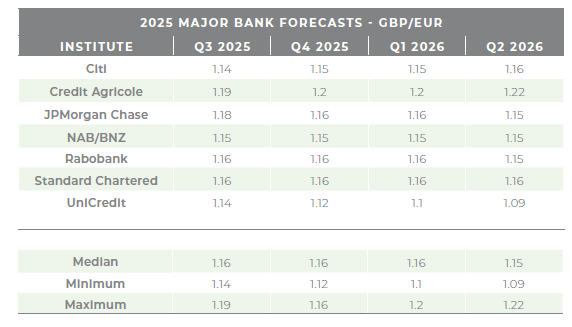

The euro has had the upper hand over the pound since the end of May. Our last report forecast a tight range of 1.18-1.22 for GBP/EUR, and while sterling climbed into that region after taking an early battering, the enduring memory of this quarter will be a much less competitive June, which saw the pound dip towards 1.16.

That the euro has achieved this with ultralow interest rates (in comparison to the pound, at least) might be considered an oddity. However, that would be to ignore the galvanizing impact of an imminent German government spending splurge, which promises a sharp pivot after years of restraint.

EUR/USD

You’d have to go back almost four years to find a better EUR/USD exchange rate. Granted, the US dollar has made its worst start to the year since 1973, but it’s worth highlighting the impressive performance the euro has put in since April.

There are several pinch points for the dollar. The unavoidable problem it faces is that international demand for government debt has collapsed at the same time as the current account deficit has increased. That has created a troubling mismatch, with markets waiting for the US dollar to devalue before reviewing their “sell dollar” approach.

SUMMARY

Will 2025 be remembered as the year that ended the US dollar’s dominance? Up until recently, you’d be hard-pressed to argue it wouldn’t. In fact, the overarching trend of the past three months has been an almost complete market 180. Praise and excitement at the beginning of Trump’s term has curdled into something closer to exasperation, even among the heavyweight banks who bullishly predicted runaway growth.

The issue of tariffs has snowballed into something larger. Investors are wrangling with a foundational shift in the global financial order, injecting impetus into emerging markets but posing problems for traditional powers, most notably the United States. Trump Always Chickens Out (shortened to TACO) has become the boardroom shorthand for healthy scepticism of the president’s rhetoric.

For the moment, the Israel-Iran conflict proved old habits die hard. Safe haven flows poured into the US dollar, which helped it end the quarter on something of a high. If we zoom out though, the long-term trend feels less positive this time.

MIDDLE EAST ON EDGE

The prospect of conflict between Israel and Iran has long kept financial markets up at night. More than that, mutual antipathy between the two nations has bubbled away as an undercurrent of political discourse for a generation. Perhaps it’s no surprise that it erupted now.

With the help of American “bunker busters” and B52s, Israel launched a strike against Iranian nuclear facilities. Iran subsequently retaliated and threatened to close the Strait of Hormuz, through which around a fifth of the world’s oil travels on container ships. A hastily brokered ceasefire helped restore calm, but markets have been shaken by a scenario long regarded as the most troublesome in the Middle East.

EURO AIMS FOR ELITE STATUS

Recent events have presented the euro with a real opportunity. Prominent figures at the European Central Bank (ECB) – not least ECB

president Christine Lagarde – have suggested the single currency could in time usurp the US dollar to become the world’s de facto reserve currency.

Whether this is a “global euro moment”, as Lagarde put it, may rest on the eurozone’s ability to rally its member states. France is leading a push to issue more collective debt that would increase the euro’s appeal as a safe haven. But memories of the eurozone debt crisis make this a deeply divisive issue. Fearing they will be stuck with the bill, Germany and the Netherlands have already objected, and more hurdles could stand in the way of the euro going global.

UK ECONOMY

An unexpectedly strong start to the year saw the UK economy draw strength from its dominant services sector. Better weather helped boost sales in pubs and restaurants, too, but growing hopes that the country had turned a corner would prove premature.

The economy shrank by 0.3% in April as higher bills and uncertainty around tariffs (among other things) dampened activity. Meanwhile, the yield on ten and 30-year government debt has climbed uncomfortably close to highs set in the Global Financial Crisis, deepening the chronic public sector overspend. Finding an engine of growth among consumers may prove tricky. As of June, spending power had fallen by 1% and the average credit card debt per household was estimated to top £2,500.

The government’s strategy can be boiled down to investing in key projects and reducing red tape. But this requires patience. Even with consumer sentiment rising slowly, “now is certainly not the time to hope for the proverbial ‘light at the end of the tunnel’”, as Neil Bellamy of market research firm GfK summarised.

BANK OPENS DOOR TO CUTS

The Bank of England’s June meeting saw three policymakers vote for an interest rate cut and six vote for a hold. Among those championing more urgent action was Deputy Governor Dave Ramsden, who had been predicted to be cautious. Despite the decision, Governor Andrew Bailey pointed to evidence of reduced labour demand and hiring intentions, boosting the odds the Bank could cut again as soon as August.

Currency markets are expecting two or three additional quarter-point cuts before the year is out. Businesses and mortgage owners will be hoping for the latter, but the Bank will be mindful of price pressures. Headline inflation has bobbed above 3% for the past two months, after all.

LABOUR TAKES DAMAGES

Labour’s first spending review in more than 15 years was a welcome platform to demonstrate a grander vision for the UK. Chancellor Rachel Reeves provided some big commitments, but the unpleasant undercurrent of fraught departmental prioritisation was inescapable.

The NHS, infrastructure and defence contractors were the big winners of the review, which captured billions in capital outlays in a sprint to safeguard long-term growth. However, other departments will be forced to muddle along with what amount to budget cuts, when measured in real terms.

Sir Keir Starmer deserves credit for forging a close relationship with Trump, a strategy that paid off in securing tariff exemptions for the automotive and steel industries. However, his political situation at home is much less favourable. Reform UK are surging in the polls and a Labour rebellion over welfare cuts forced a dramatic climb down from No. 10. This all came to head on a remarkable day in Westminster, when a tearful Reeves inflamed a bond market tantrum and renewed questions around government spending.

EU ECONOMY

Far from being cowed by the prospect of American tariffs, the eurozone opted to face the Trump administration down in an effort to secure a fair deal. The logic here is simple: hold out for long enough, and the president’s advisors will persuade him that any deal is better than no deal.

It is a high stakes game, particularly because it uses a wobbly economy as collateral. The European Commission sharply downgraded its 2025 growth forecasts for the eurozone to under 1%, driven by lower export projections.

When in a tight spot, the eurozone typically looks to its economic powerhouse for a way out. On this occasion, the German government has sent a strong signal it will not waste time when it comes to investing in infrastructure and defence. According to Deutsche Bank, the draft budget agreed in June could see the country’s GDP growth surge to 2% by the end of 2026.

ECB HITS TARGET

The European Central Bank (ECB) pulled off the great heist of substantially tightening interest rates without hindering the euro. Four consecutive quarter-point cuts have taken the ECB’s main interest rate down to 2%, even as rival rate setters have struggled to cross the 4% threshold.

Inflation is cooling and thoughts are turning to the end of this monetary cycle. The eurozone is “in a good place”, according to Christine Lagarde, with higher real incomes, government investment and better financing options (thanks in part to lower rates) set to brighten the picture in the coming months. That’s assuming all goes to plan, of course.

THE MERZ EFFECT

New German Chancellor Friedrich Merz has provided a welcome change in tone since replacing the beleaguered Olaf Scholz. With his finance background and explicit desire to invest in infrastructure and industrial projects, investors are quietly confident that Europe’s largest economy can rebound amid growing threats.

That’s not to marginalise those threats, which are very legitimate. The eurozone as a whole is still fighting battles on several fronts, from trade to Tehran. Despite this, it has still been able to swell its ranks, with Bulgaria set to become the 21st member of the eurozone at the start of next year. Officials heralded this step as another line in the defence against Russian influence.

Conservative candidate Karol Nawrocki was initially declared the winner of the Polish presidential elections. However, after a huge backlash that saw more than 50,000 complaints of voting irregularities, the Polish supreme court was forced to step in to uphold the decision after weeks of turmoil.

US ECONOMY

Is there any other economy that could navigate Trump 2.0 and emerge in one piece? The president has the immense fortune of sitting at the helm of a historically resilient economic power, one that has proved sufficiently dynamic to shrug off major challenges over the past

few years.

But anxiety is growing about the future direction of travel. Growth dropped off notably in the first quarter of the year, and those reading the tea leaves for signs of stress are pointing to a nosedive in consumer sentiment and personal income. Continuing jobless claims (i.e. those receiving unemployment benefit) have meanwhile risen to their highest level since November 2021, even if job openings continue to impress.

According to the Bureau for Labour Statistics, Q1’s 0.5% GDP slowdown was mainly the result of increased import volumes, associated with new tariff announcements. To echo the thoughts of the Fed’s chair, we may well need more time to gauge the full impact of the president’s policies.

TARIFFS OPEN FED RIFT

Federal Reserve chair Jerome has justified his watchful approach to monetary policy by highlighting the future impact of trade barriers on the American economy. Yet at the Fed’s June meeting, the first signs of a difference in opinion among the board began to show.

In the face of intense pressure from the president, Powell has been stoically hawkish. On the other side of the debate, Christopher Waller and Michelle Bowman (heir apparent to Powell, judging by Trump’s praise of her) began to push the dovish case. The Fed has not announced a cut so far this year and, wary of stunting growth, some policymakers and politicians are getting itchy feet.

ONE BIG, BEAUTIFUL BET

Donald Trump wanted his “Big, Beautiful Bill” to form the cornerstone of his legacy, but wrangling lawmakers into lockstep required a titanic effort as well as a tiebreaking vote from the vice president. Republicans questioned the impact of huge tax cuts on the national debt. Some experts predict the bill could add $3 trillion to an already eyewatering $37 trillion deficit.

As in Trump’s first term, the political dominoes have toppled with regularity. Elon Musk’s tenure as chief of the Department of Government Efficiency (DOGE) is over. Not just over but scorched by a remarkable (and very public) falling out with Trump over that very bill.

Protests against immigration and the administration more broadly culminated in the National Guard being sent to Los Angeles, but the president still has bigger political worries. FOX News has been the surprise but vocal mouthpiece of the MAGA movement’s anti-interventionist streak. When conservative anchor Tucker Carlson is grilling the Secretary of State about Iran in a viral interview, you know things are bad.

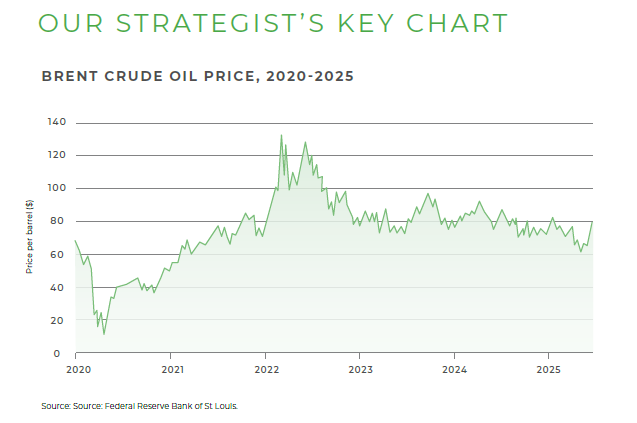

Oil has been a key talking point alongside the tensions in the Middle East. After Iran’s leaders voted to close the vital Strait of Hormuz, the assumption was that the price of Brent Crude oil could spike by as much as ten cents overnight.

The remarkable thing is just how little this conflict has affected oil indices (so far, at least). Our chart to watch captures the daily price of the Brent Crude index over the past five years. Note how small the spike was last month when compared to Russia’s invasion of Ukraine, for example. When it comes to conflict and grandstanding in the Middle East, oil traders have an iron stomach, but don’t expect this poise to last should violence break out again.

020 7898 0500

020 7898 0500