NOTE FROM THE MANAGING DIRECTOR

Another quarter has shot by in a blur. Unfortunately, that blur has too often been streaked by the darkness of uncertainty and upheaval. But even amid the chaos, optimism blooms.

To some, the sun is shining over Europe again. That’s certainly the glass half-full interpretation of recent events, which have seen Europe’s politicians and businesses scramble to adapt to tariffs, the threat of war and an unravelling geopolitical framework. To the pessimists, a potentially self-perpetuating trade war represents a substantial threat to commerce and growth, with the power and fluidity to dwarf great shocks like Brexit and the UK mini-budget.

We often warn of Black Swan events – the kind of sudden and complete rupture nobody expects. But what about “Grey Swan” events, predictable and rational but not accounted for until it’s too late? Tariffs fall into this category. While it is tempting to wish these scenarios

away, the risks to your profit margins and cashflow are very real.

When it comes to making tough decisions, and when those decisions are veiled in uncertainty, you can always rely on us for bespoke treasury solutions that help you navigate through the darkest waters to emerge stronger on the other side.

As the old proverb goes, “When the winds of change blow, some people build walls and others build windmills”. At Smart Currency Business, we can help you do both.

We wish you and your business a successful quarter and a happy spring. Our team are always just a call away and look forward to making your strategic objectives a reality, whatever the future has in store.

HOW DID Q1 FORECASTS FARE AGAINST REALITY?

Leading banks hedged their bets when forecasting exchange rates last quarter, a sensible decision given this new era of global disruption. Our last forecast carried predictions with a range of more than ten cents for GBP/USD and EUR/USD and only slightly less for GBP/EUR. This reflected the volatile outlook for the US dollar and the defensive outlook for Europe.

The more extreme predictions of American dominance have so far fallen flat. Rather than galvanise the US dollar, each set of tariffs has bred concern that the economy would take damage, and what was the largest about-face in US trading policy for at least a century has created deep anxiety. A slowdown in several key data indicators gave the pound and euro a lifeline, which they duly grasped.

GBP/USD

Sterling ended January dangerously close to the 1.21 minimum predicted in our last forecast. By the end of March, it had moved closer to the upper range. The slow reappraisal of “Trump trades” helped the pound regain its footing, as did an uptick in domestic inflation that reduced the chance of a fast path to lower rates.

As with so much else, the last three months were a dance that preceded the main event of tariffs. Sterling benefitted from less direct exposure to American trade ire, yet that is a story not even close to its conclusion.

GBP/EUR

The early part of 2025 saw a couple of notable peaks and troughs for the GBP/ EUR exchange rate. Admittedly, these were contained to a narrow range, but the speed of each movement contributed to a gnawing sense of volatility between the rival currencies.

Interest rate disparity between the European Central Bank (ECB) and the Bank of England continued to support the pound. For its part, the euro has struggled to shrug off the perception that tariffs will be damaging to growth and stymy key industries keen to make a comeback. All eyes are on the data to gauge the impact of these tariffs on business and industry.

EUR/USD

A dreadful March for the US dollar saw it endure its worst month since 2022. The euro advanced by over five cents over the dollar and made a swift start to April following the tariff backlash.

The highly anticipated “liberation day” did more harm to the US dollar than good. EUR/USD picked up almost 2% on the night of 2 April for several reasons, but perhaps the most significant was that it destroyed the narrative these were finely tuned policy instruments. Instead, the simplistic calculations that made up Trump’s gambit demonstrated a desire to address trade imbalance rather than more sophisticated, ambitious aims.

SUMMARY

Optimism in financial markets reached fever pitch somewhere in early February. A flurry of executive orders from the White House seemed to confirm that the president was ready to ease regulations as an opening salvo in a business-friendly tenure. Those halcyon days are long gone.

Tariffs are a real worry to business and consumer alike. That’s because they are almost guaranteed to be inflationary, passing the burden of what is essentially a tax onto the importer and creating barriers where once there was fluidity. Global markets recoiled at the on-again, off-again style Trump has adopted. When nobody is able to read the president, it becomes hard to stay on side of his temperament.

Republicans named 2 April, the day global tariffs took force, “Liberation Day”. In truth, it’s hard to see who is being liberated. From the American consumer to the European business, the blunt instrument of tariffs raises the temperature in an already unstable world. According to research by Aston University, blanket tariffs on all US imports could cause a $1.4 trillion hit to the global economy. Far more has already been wiped off major stock indices.

POST-WAR CONSENSUS SHATTERS

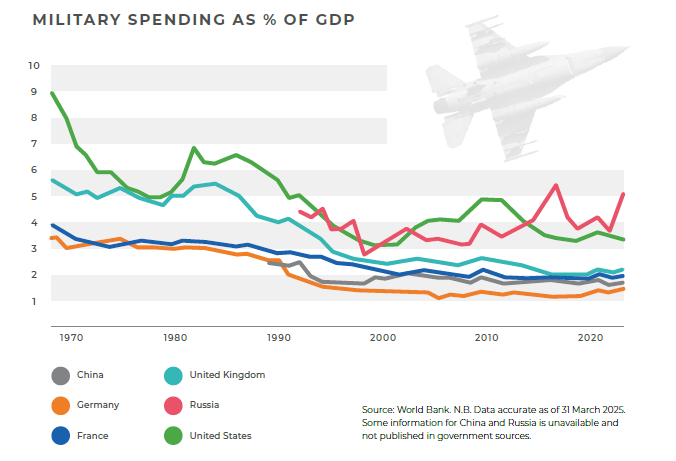

Since 1945, the balance of power in the West has leaned toward the United States. Western policy has shaded pro-democracy, pro-business and sought to guide the world towards liberalism through spheres of economic influence (plus the odd war).

New forces have emerged to wrest these old allies from that doctrine. America has aligned itself with Russia, while Trump’s unusual diplomacy and broad tariffs have prompted frantic reaction in capitals the world over.

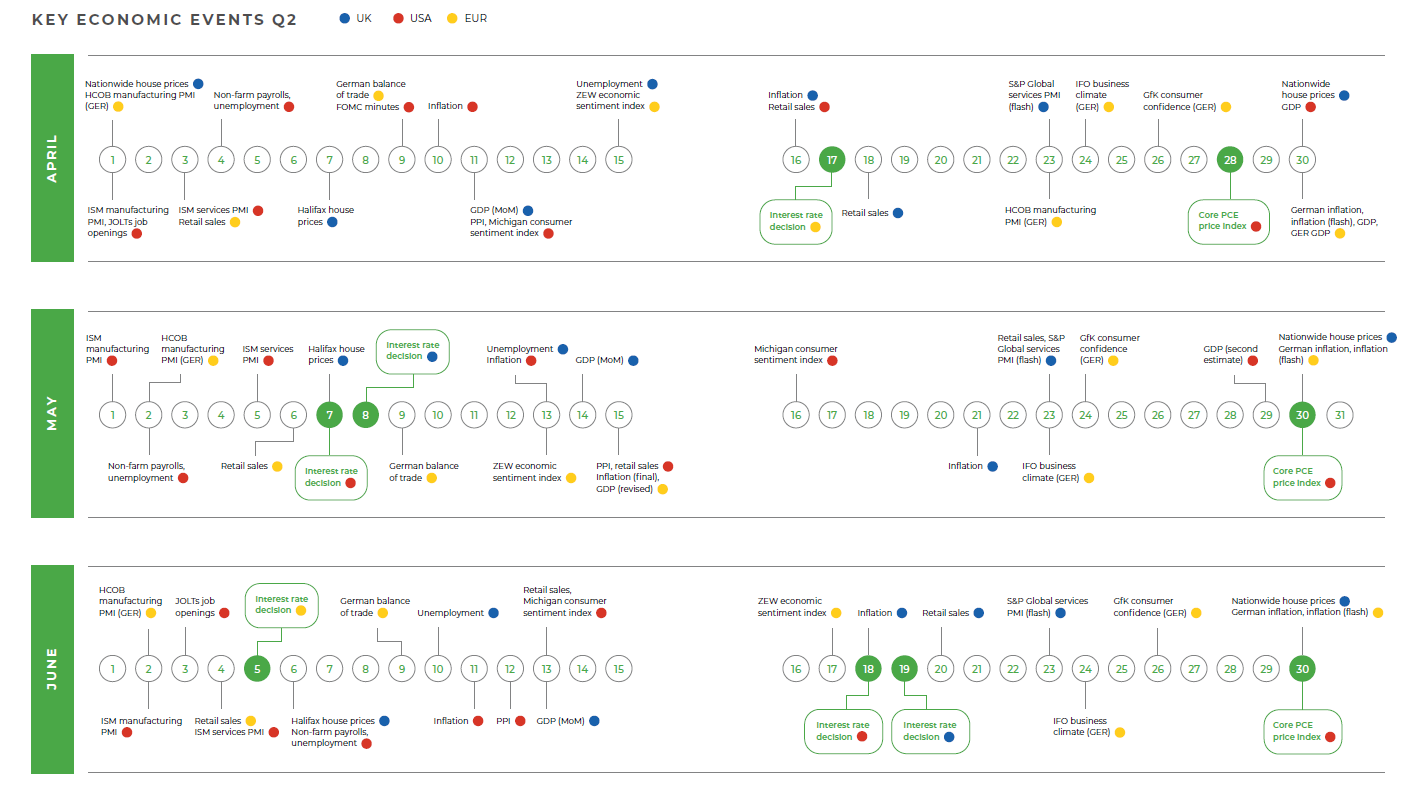

BANK AND FED CHANGE THEIR TUNE

While the ECB has been quick to cut interest rates, the same can’t be said for the Bank of England and the Federal Reserve. In fact, policymakers from both those institutions conducted a subtle but nonetheless significant pivot over the first few months of the year. Sticky, stubborn inflation forced a halt on interest rate cuts at the March meetings. Bank of England governor Andrew Bailey has had his eye on services inflation, while across the Atlantic Federal Reserve chairman Jerome Powell has warned against the longterm implications of tariffs. The burden on central bankers will only grow as economies seek to navigate the new terrain.

MARKET-MOVING EVENTS THIS QUARTER

UK ECONOMY

Chancellor Rachel Reeves was forced to implement a £14bn “repair job” on public finances with the spring statement. Essentially a patchwork of spending cuts and accounting tweaks, Reeves managed to balance the books for the time being, although the next few months could be turbulent in the extreme.

If the chancellor was in the mood to celebrate her work, the Office for National Statistics (ONS) played party pooper. The ONS slashed the UK’s growth forecast from 2% to just 1% in 2025. A slight upgrade in its assessment of future GDP projections was not sufficient to quiet scrutiny, particularly with tariffs predicted to shave anywhere from 0.2% to 0.5% off economic growth and raise the risk of a recession.

A new tax year promises fresh pain. “Awful April”, as it has been dubbed in some sections of the media, brings higher energy bills, council tax and marks the start of increased national insurance contributions for employers. As tariffs start to bite, Reeves and Labour are far from out of the woods.

BANK OF ENGLAND

Previously cautious over inflation, the fallout from the brewing trade war is expected to change the Bank’s strategy. Andrew Bailey has been urged to step in with emergency measures to prop up financial markets, although he has so far resisted this temptation.

Bailey recently urged authorities and officials to “come together” in the spirit of cooperation rather than trade protectionism. Putting aside the likelihood US officials will shrug this off (as well as the fact flower power and free love aren’t exactly Mr Bailey’s brand), the UK economy needs clear and decisive action from its policymakers more than ever. The next few rate decisions provide an opportunity to supply this.

STARMER FALLS FROM THE TIGHTROPE

Sir Keir Starmer has attempted to position the United Kingdom as an intermediary between Europe and the US. His strategy with Trump has been equal parts flattery and appeasement. All things considered, it had been successful, although a rather demeaning meeting in Washington saw Starmer lay it on thick with a royal invitation from King Charles.

The 2 April tariffs showed the limits of this strategy. Despite all the efforts to build relationships and preserve the chance of a trade deal, Trump still decided to impose tariffs on the UK, although the 10% levy is lower than other economies face and raises hopes a deal can be reached quickly.

Starmer isn’t short of problems at home, either. The economy hasn’t been able to find any sort of momentum, requiring Labour to cut even more fat from government spending to balance the books. As markets reacted to the Liberation Day tariffs, the prime minister announced plans to protect key industries but some analysts think spending rules will need to change again to escape punishing consequences for businesses and the economy.

EU ECONOMY

America’s loss has been Europe’s gain. As stock markets tumbled in New York, Europe has put together a ferocious rally that has since seeped into the wider economy. German consumers have reported multi-year highs in future expectations, according to influential studies from the Centre for Economic Research (ZEW) and research firm GfK.

Europe does have significant exposure to American tariffs — that cannot be denied. The auto industry has been a particular target of Trump’s tariffs and an effective tariff rate of 20% on all goods will be a bitter blow. Yet the eurozone finds itself in a far happier position than a few months ago, when the hand wringing over tariffs was at its height.

Spending and debt reforms have sparked hopes of a more self-assured economic collective. Europe is also hoping to attract investors who have become disillusioned by America’s trajectory, but it must first prove it has the economic fundamentals necessary to grow those funds.

ECB

The European Central Bank announced its sixth quarter-point cut in under a year at its last meeting. This aggressive action has been fuelled by two main economic considerations: cooling inflation and weak growth. Significant military spending financed by debt will help the latter but could spill over into renewed price pressures.

ECB president Christine Lagarde warned that tariffs would have a negative impact “the world over”. The eurozone will be hit harder than most, leaving Europe’s fragile recovery in the hands of these technicians. Policymakers will now be forced to nurture the economic optimism without free and easy access to their largest trading partner.

MERZ KICKSTARTS SPENDING REVOLUTION

The gloves are off for the German government. For several generations, politicians and the public have shied away from military spending, an understandable holdover from recent history that has been added to the German lexicon: Vergangenheitsbewältigung – overcoming the past by confronting it.

But the world is changing and chancellor-in-waiting Friedrich Merz understands this. A seismic vote in the Bundestag unlocked billions in spending to bolster defence and revamp creaking infrastructure. Under the previous debt brake, Germany had only been permitted to spend paltry sums on its security. Now, it can borrow aggressively and there is likely to be a market for that, with Germany’s debt-to-GDP ratio sitting well below the world average.

The European Union has followed this with its own spending revolution. Taken together, these reforms represent the first stirrings of a powerful military counterweight to Russia and America. It is also a diplomatic step forward that allows Europe to exclude countries like the UK, Turkey and the United States from weapons contract — a lever it has already pulled.

US ECONOMY

There is one question that matters to American markets: how will trade tariffs impact the economy? Ordinary people are likely to be less fussed about the politics than the realities they face every day. If the last election taught us anything, it is the prices on the shelf and food on the table that will be remembered.

On that topic, America’s avian flu outbreak led to a rather embarrassing request to Denmark —subject to sustained sabre rattling over Greenland, remember — for additional eggs. The Michigan University consumer sentiment score took a battering in March, and everything from job openings to new construction projects have slumped as confidence drains away. Effective tariffs of over 100% may support American industry over time but will cause significant pain to consumers before then.

Goldman Sachs now thinks there is a 45% chance the US will be in a recession by the end of the year. That opinion might be overly gloomy, but it underscores just how quickly the narrative has shifted. Just like in 1930, the rhyme of history has made tariffs the central player at an economic pinch point.

FEDERAL RESERVE

The president is keen for the Federal Reserve to get cutting. Powell is intent on ensuring inflation is under control before doing so – unlikely to be soon given the core PCE price index climbed again in March. The curveball comes from the risk of tariffs stunting growth. Markets now think Powell will have to move faster to cut, raising the risks of stagflation.

Powell will be keeping a close eye on the bond market too, which sold off after the tariffs were announced. The yield on long-term US treasury debt leapt up, indicating a loss of appetite for this former safe haven asset. Anxiety is spreading that the United States could drag the world into an uncontrollable financial event on par with 2008 and consign the dollar’s dominance to the scrap heap.

THE CHAINSAW THROUGH GOVERNMENT

Voters knew the second coming of Donald Trump would be different. But did they know it would be like this? A team made up of fewer traditional Republicans and more MAGA stalwarts has helped the new administration channel Silicon Valley to “move fast and break things”. Even the president’s critics will accept things have moved fast. Several moments of embarrassment – notably the remarkable leaks in the Signal group chat – evidence success on the second part of this mantra.

Trump has given Elon Musk (of Tesla and X fame) unprecedented access to sensitive data as head of the Department of Government Efficiency (DOGE). Musk has returned that access with a scorched earth approach that aims to eliminate 10% of government jobs. Few public workers have been spared the axe, from nuclear scientists to air traffic controllers. Some have since been rehired at significant cost to the taxpayer, and even Musk’s days in government appear to be numbered after a botched bid to sway the Wisconsin supreme court election.

The vaunted system of checks and balances is being tested to its limit. Trump hasn’t helped by discussing running for his third term as president (a proposal unambiguously prohibited by the 22nd amendment to the constitution). Division within the electorate shows no sign of disappearing soon.

OUR STRATEGIST’S KEY CHART

020 7898 0500

020 7898 0500