Inflation is falling but what could this mean for my business margins?

By Christopher Nye March 6th, 2023

Britain's monthly inflation expected to fall to 9.6% .

UK inflation is falling in line with the Bank of England’s expectations however, the rate remains well above the BoE’s 2% target. Investors are keen to keep a close eye on inflation rates, as an unexpected change in rates could impact currency rates in the long run.

It is no secret that inflation in the past few years has rocketed to historic levels. Just last October, the UK’s inflation rate soared to a historic high of 11.1%, while rates in the Baltics hit the highest in the euro area – and are still rising (Estonia’s is expected to increase from 17.5% to 19.8%)!

Recent figures released by the Office for National Statistics (ONS) show that inflation is slowly on the decline in line with the BoE’s predictions, however the price of consumer goods is still very high.

Why market-watchers keep a close eye on inflation

Every month, the ONS releases data on inflation, which gives market-watchers huge clues on how much consumers are spending on goods and services in the UK. It also gives the Bank of England a good indication on what type of stance is best to take with its monetary policy.

“There are signs that inflation might now have turned a corner and begun to fall a little. We need to make sure it continues to fall and stay low.

We expect inflation to begin to fall from the middle of this year and be around 4% by the end of the year. We expect it to continue falling towards our 2% target after that.” – Bank of England

Of all the types of inflation, there are two that investors are keen on: headline inflation and core inflation. Headline inflation measures consolidated inflation figures within a country’s economy (including commodities like energy, food and drinks) and tends to be more volatile as the prices of these commodities can vary. Core inflation on the other hand, does not include these commodities and focuses strictly on the change in the costs of goods and services.

The biggest contributions to inflation

The latest results published on the 17th February revealed that yearly inflation in the UK fell to 10.1% which was also below market forecasts of 10.3%. The data also confirmed that inflation fell for a third consecutive month and hit its lowest levels since September last year. Overall the UK’s consumer price inflation (CPI) fell 0.6%, marking the first decline in 12 months and the biggest since January of 2019.

Despite this, inflation is still in the double-digit territory and the BoE will work tirelessly to bring it back down. Here are some of the biggest contributions to the recent results:

- Transport the largest downward contribution in January’s inflation came from transport (3.1% vs 6.5%), particularly passenger transport

- Food and hospitality restaurants and hotels also made a large contribution (10.8% vs 11.3%). However, prices rose at a slower pace for food and non-alcoholic beverages (16.7% vs 16.8%).

- Clothing and footwear New Year sales saw clothing and footwear grow at a slower pace (6.2% vs 6.5%) and furniture (9.2% vs 9.8%), in line with expected discounting

On March 22nd, the ONS will release fresh figures for February, which are also expected to fall again – this time from 10.1% to 9.6%.

How does inflation data impact currency?

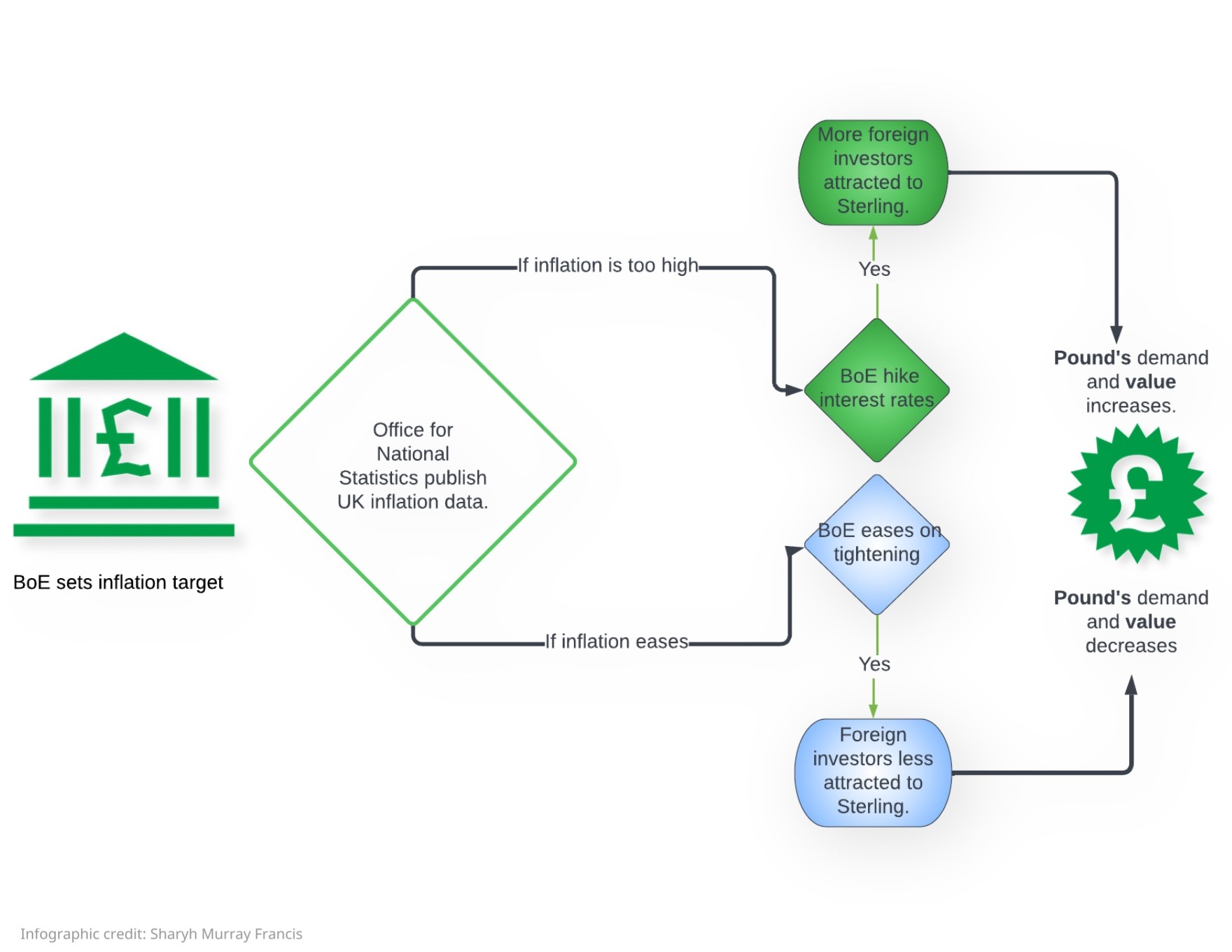

In the grand scheme of things, inflation data can be a key contributing factor to a currency’s performance against its peers. The infographic below demonstrates how inflation data could impact the pound’s rates.

In short, if inflation falls to 9.6% as expected, this would mark the fourth-consecutive decline, but will still be a very far stretch from the Bank’s 2% target. In theory, a sharp decline could prompt the BoE to take its foot off the gas with hawkish monetary policy (which could turn foreign investors away), but if unruly rates remain, the Bank could very well decide that tightening is still the best course of action.

This was reiterated in a speech last Wednesday at the Cost of Living Crisis Conference in London, where BoE governor Andrew Bailey warned that “The incoming data will add to the overall picture of the economy and the outlook for inflation, and that will inform our policy decisions.” In the coming weeks, all eyes will be on the ONS for its next inflation release.

Pound-watchers will also be listening closely for the BoE’s next interest rate decision which will be made on the following day (March 23rd).

How inflation can impact your business

Businesses that make large overseas transactions may be at a disadvantage if sterling’s rates suddenly drop. As demonstrated above, inflation can have impact currency rates, which in turn can also impact margins.

Markets are volatile and unpredictable, so with that in mind, it is vital to ensure your business has the correct risk management strategies in place.

To learn more about how Smart can help protect your business against market volatility, call our team today on 020 7898 0500. We will be delighted to help.

020 7898 0500

020 7898 0500