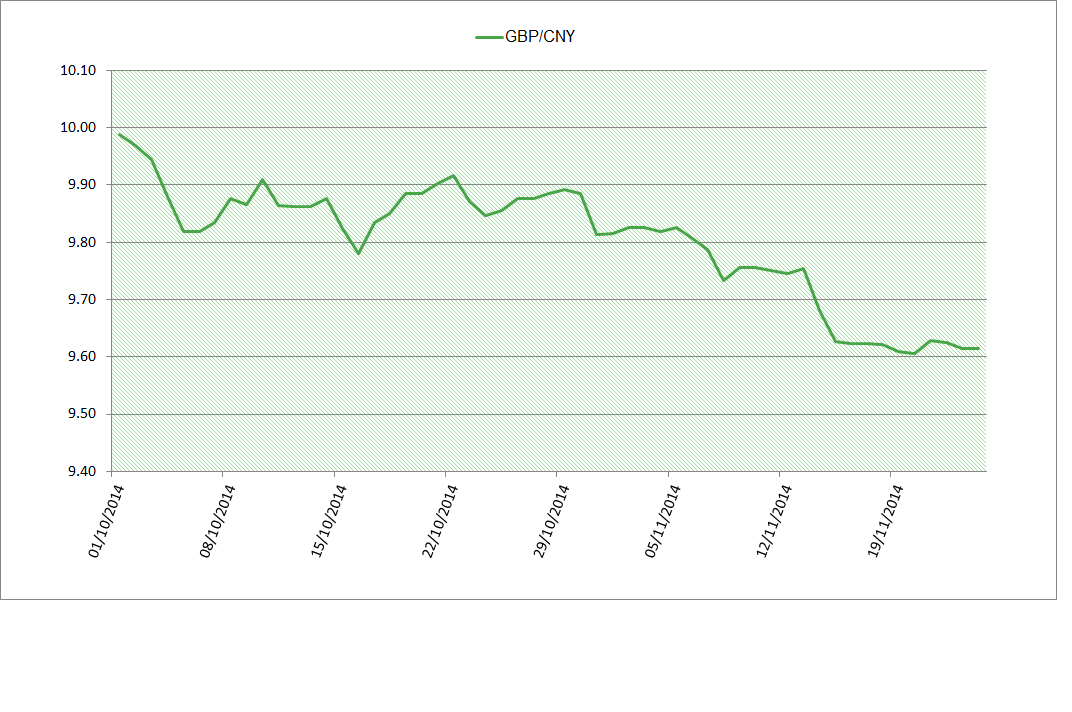

25 November 2014

CNY (Chinese renminbi) Current Rate:

CNY 9.6247 /£1; CNY 6.1425/US$1

The demand for offshore renminbi was evident mid-November as a Shanghai-Hong Kong stock-trading programme was initiated, as was a regulation allowing Hong Kong residents to purchase the Chinese currency without any restrictions on the amount.

Despite easing currency flows, the Chinese economy continued to battle subpar growth in the past month. With economic growth slowing to a five-year low in 7.3% in the last quarter, the People’s Bank of China (PBC) surprised markets by reducing its one-year deposit rate from 3.0% to 2.75% in hopes of stimulating the economy. The PBC also cut its one-year lending rate from 6% to 5.6%.

Chinese stocks rose and the renminbi weakened on the back of this news. Although the forecasts below indicate that the renminbi could strengthen, this latest news suggests that the renminbi could remain weak, but given China’s move towards a free-floating exchange rate, it is trickier to predict what the PBC will do, given the lack of precedence. As such, UK businesses trading in renminbi or starting to trade in the currency are encouraged to have robust currency strategies in place in order to minimise losses and mitigate risk from a currency that is potentially open to significant volatility.

China also has plans with Russia to make trade settlements in renminbi and roubles, a move which could wrest more influence from the US dollar, particularly in the energy market. If successful, this could also potentially strengthen the renminbi.

Rate forecasts for GBP/CNY:

| Time Length | Rate |

| 1 month | 9.7920 |

| 3 months | 9.7600 |

| 6 months | 9.6465 |

Forecasts accurate from 25 November 2014. Data taken from Reuters’ poll.

Data sourced from GBP/USD and USD/CNY cross.

For help and guidance on making international payments using Chinese renminbi,

call 020 7898 0500 or send us an email

020 7898 0500

020 7898 0500