What is business optimism and how does it impact the market? Well, business optimism has a significant impact on markets and exchange rates (especially if the expectation is not met) so economists take great interest in the data. Business optimism can be found on the data calendar.

We explain the various ways business optimism is measured, and how investors use this data to measure the success of an economy.

What is business optimism?

In business, optimism is a mindset that encourages growth and problem-solving strategies. Levels of optimism may fluctuate at different points of the economic calendar due to political or global events. Understanding these changes gives businesses and investors an insight into the current state of an economy as well as an indication of possible turning points in the future, like recessions or changes in demand. This is also useful information for predicting what may happen in the currency market and basing business decisions on them. For example, if data shows that people are more likely to be spending money on buying overseas property in the spring and businesses think this will continue to happen, an estate agent may employ more staff.

Levels of optimism are measured by the data collected from regular surveys and there are a wide variety of surveys – some covering one country and others covering several. We explain how the Ifo Business Climate, CBI Business Optimism, Gfk Consumer Confidence, NFIB Small Business Optimism Index and ZEW Economic Sentiment Index all provide useful data on levels of optimism within an economy.

CBI Business Optimism

The Confederation of British Industry or ‘CBI’ is a non-profit organisation working to support the UK business industry on national and international matters. The CBI aims to help UK businesses grow and mitigate risk.

The CBI measures levels of business optimism by surveying manufacturers across Britain and data is released on a quarterly basis. In 2020 for example, data revealed that optimism in British industries was the strongest it had been in 6 years. Key findings from CBI’s survey revealed that “Business optimism improved significantly in the three months to January (+23% from -44% in October)”. Findings like these indicate a turning point within the economy and can allow businesses to make predictions about how the economy and currency market may perform.

Ifo Business Climate

The Ifo Business Climate Survey is Germany’s primary indicator of economic activity and is released on a monthly basis. The survey is conducted on a monthly basis and provides data from roughly 9,000 German firms in manufacturing and construction, trades and the service sectors. As Germany is the largest economy in Europe, global economists, investors and businesses keep a close eye on its performance.

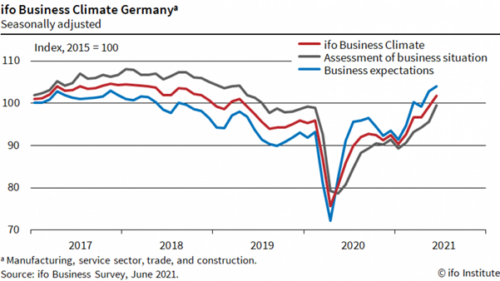

From the graph below, it is clear to see that levels of optimism took a very low turn during the first half of 2020 compared to 2017.

In 2020, levels of optimism dropped rapidly to around 70 Index points (nearly 30 points below the baseline) compared to 2017 where figures were much more optimistic, coming in at just over 100 points. The global pandemic is likely to be one of the key reasons for the steep drop in levels of optimism.

GfK Consumer Confidence

GfK provide one of the most reliable measures a of consumer confidence through their Consumer Confidence Barometer or ‘CCB’ which is released on a monthly basis. Currency markets and investors can analyse to gauge the future success of Britain’s economy.

The CCB provides a monthly insight into how consumers feel about Britain’s economy. Although the focus of this data is on consumers, this information is still useful in predicting supply and demand changes as it indicates whether consumers are likely to make major purchases or to save.

NFIB Small Business Optimism Index

The National Federation of Independent Business or ‘NFIB’ is a small US businesses association with aims of expanding and developing small businesses. Their focus is a lot smaller in comparison to Ifo Business Climate Survey, with data gathered from roughly 620 NFIB members.

Their June business optimum survey revealed small business owners are growing more pessimistic, with the NFIB Index falling by a staggering 3.6 points (below expectations). According to the data, 34% of owners blame inflation as the ‘single most important problem in operating their business’. These low figures give US economists and business owners the insight needed to take necessary precautions against events such as a possible recession.

ZEW Economic Sentiment Index

The ZEW Financial Market Survey is made of data collected from approximately 350 economists, analysts and other experts. The Survey is conducted on a monthly basis and provides an indication of expert opinions on economic issues in Germany. The ZEW Economic Sentiment Index is invaluable to businesses and economists as the specialist opinions provided are used to gauge economy trends.

In July the Index plummeted by -58 points (from -28 in June) the lowest score in 11 years and well under market expectations. Concerns about energy supply in addition to interest rate hikes and restrictions following the pandemic are to blame for these incredibly low scores.

Through analysis of data around business optimism, currency markets and investors can effectively plan for future economic activity and be well prepared for changes in demand.

020 7898 0500

020 7898 0500