Smart Currency at London Fintech Week

The risk management partner for international businesses in these uncertain times

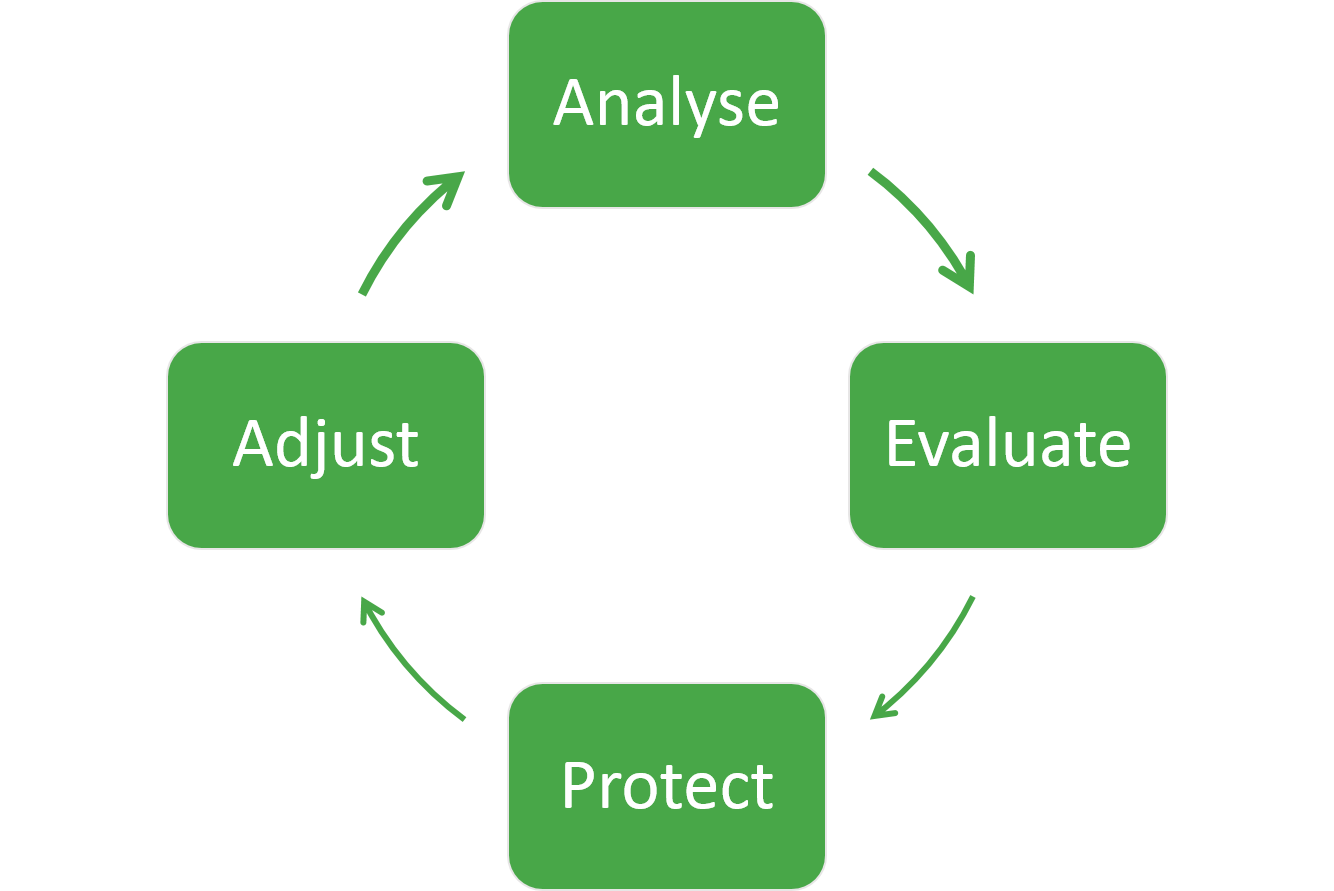

Analyse

A business’s currency exposure and foreign exchange risk as well as existing risk management processes.

Evaluate

The impact currency fluctuations can have on the business and establish the management’s risk appetite.

Protect

Put a currency risk management strategy in place that matches your requirements and use tools to implement it.

Adjust

We also help adjust your currency risk management strategy over time as your business evolves.

The risk management partner for international businesses in these uncertain times

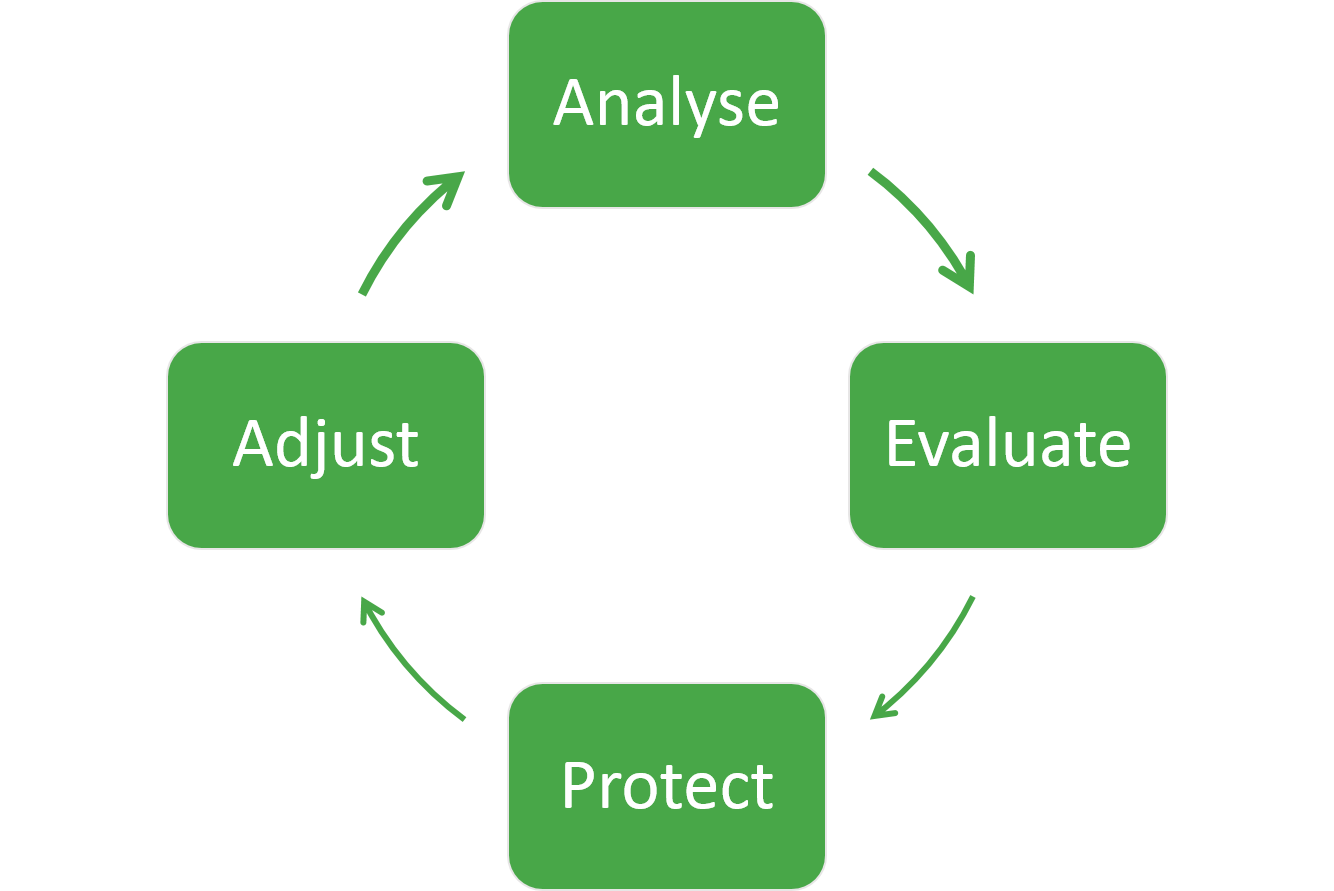

Analyse

Analyse

A business’s currency exposure and foreign exchange risk as well as existing risk management processes.

Evaluate

Evaluate

The impact currency fluctuations can have on the business and establish the management’s risk appetite.

Protect

Protect

Put a currency risk management strategy in place that matches your requirements and use tools to fulfil it.

Adjust

Adjust

We also help adjust your currency risk management strategy over time as your business evolves.

Get in touch with us for more information

Smart Currency has been providing currency risk management and payment solutions since 2004.

Particularly when there is as much uncertainty in the markets as there is now, it is impossible to forecast currency movements. That becomes apparent when you look at the major banks’ currency forecasts which all contradict each other, some even predict the exact opposite to happen.

Now, that’s where we come in. With our financial tools and technology, we can help businesses reduce or even completely remove currency exchange rate risk. This allows businesses to plan and budget, and ultimately protects margins.

We offer a range of currency risk management solutions, including forward and option contracts, to suit different businesses. The channels through which we offer these solutions include:

Smart Trader

Our online platform allows you to easily manage your risk, at a time that suits you. From setting up beneficiaries, locking in exchange rates and making payments to tracking your transactions. The platform was designed particularly for clients with regular payments to multiple beneficiaries.

Smart Risk Manager

A simple, comprehensive online solution for currency risk management processes:

- See where your organisation has currency exposures relevant for reporting and risk mitigation

- Understand what various hedging strategies involve and the impact that not having a hedging strategy could have on your business

- Put an effective currency risk management strategy in place and implement it with Smart Currency’s wide range of risk management tools

Smart Automation

Scale through technology integration. Interface your systems with ours to access the same suite of risk, trade and payment features you can find on our online platform with the additional benefit of speeding up delivery times, reducing operational burden, and eliminating human error and mitigating currency risk.

Foreign exchange options can carry a high degree of risk and are not suitable for everyone as they can have a negative impact on your capital. If you are in doubt as to the suitability of any foreign exchange product, Smart Currency Options Limited strongly encourages you to seek independent advice from suitable financial advisers.

020 7898 0500

020 7898 0500