Mark to market risk affects countless treasury teams, but it is a complex and misunderstood problem.

Last updated 31 October 2025

Introduction

Businesses encounter risk at every stage of the payments cycle, but mark to market risk is one of the most frequent (and most commonly misunderstood) issues.

Even the most well insulated companies can be left exposed if markets move against them. That’s because routine market fluctuations can change the value of their hedges, meaning they can either face additional (or unrealised) costs at settlement. This is the result of mark to market valuations changing the extent of their exposures over the course of a certain time frame. As we’ll see, those exposures can wreak havoc on free cashflow and other key financial metrics.

Table of contents

Mark to market risk

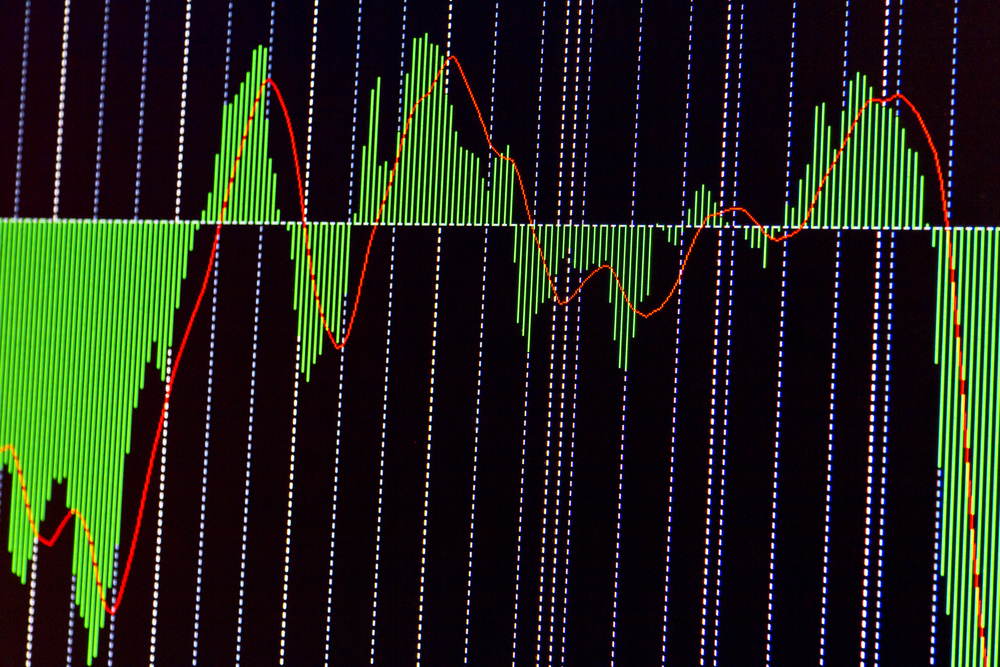

Market to market risk is the risk to your cashflow, credit headroom and other underlying key financials caused by currency volatility and any unrealised losses that result from this.

Those versed in treasury management will be familiar with the most common foreign exchange products. These include forward contracts, spot contracts, and options. Businesses use these products to ensure they key financials are protected amid the everyday fluctuations with markets.

However, it often isn’t as simple as signing on the dotted line and walking away. Many foreign exchange contracts are “open”, meaning settlement occurs several months down the line. If the GBP/USD exchange rate moves by three cents in that time, you might find the mark to market risk of routine contracts moves significantly.

Mark to market valuations reflect the current value of a foreign exchange position rather than its value at the time of purchase. In many ways, this can aid in transparency and make it easier for accounting teams, executive boards and regulators to maintain oversight in a complex market. However,

Why do exchange rates change

Of course, none of this would be a problem if underlying exchange rates were predictable. The issue that treasury management professionals are all too aware of is that the value of any given currency changes almost every second. With trillions of dollars traded every day across hundreds of currency pairs, the sheer volume of volatility of trading is enough to shift the value of any currency.

While there are many nuances, the most common causes of currency volatility are economic, fiscal, and geopolitical. The constant barrage of news that comes across the ticker means that exchange rates are constantly re-appraised and scrutinised. Interest rates – and in particular, the disparity between one central bank’s baseline rate and another’s – are also significant drivers of pricing.

Keep in mind that FX is a notoriously opportunistic market. Investors around the world often scour pricings looking for an opportunity to make easy money. Institutional investors, who often represent trillions of pounds in combined financial interests, have more than enough clout to move pricing. For that reason, exchange rates can sometimes fluctuate out of session (i.e. when other investors are tucked up in bed) and may seem irrational at first glance.

In truth, currency markets and exchange rates can be baffling. For more in-depth analysis of market trends, and to see why it’s so hard to trust even expert opinions, download our latest Quarterly Currency Forecast.

Margin calls

Businesses may face “margin calls” as a result of these fluctuations. When exchange rates move against you, FX counterparties (banks, brokers or specialist providers) may issue a request to post additional collateral to guarantee the valuation gap. That’s because they also carry liability for the transaction.

Essentially, margin calls are a mechanism that allows a financial counterparty to guarantee it won’t lose money given sudden changes in the currency landscape. Margin calls are therefore a product of the checks and balances within the system. However, even this relatively innocent explanation can cause havoc for growing businesses.

The impact on your cashflow

Margin calls can have a damaging effect on any company. Examples from various industries show that being able to anticipate margin calls will give a business a better chance of insulating itself from the fallout.

During the Covid-19 pandemic, several airlines suffered from damaging margin calls after a steep fall in the price of jet fuel. The same can be said of recent volatile moves within the metals industry, while shipping companies have struggled amid the ongoing trade war.

Margin calls can take up vast amounts of your free cashflow. Think 2022, when the ripples from the mini budget saw sterling weaken by almost 14 cents against the US dollar in under two weeks. If you had taken out £5 million in forward contracts at the start of September, you could have been staring down a mark to market change of £500,000 – likely enough to trigger margin calls.

Could your business survive taking such a significant hit to its cashflow?

How to manage market to market risk

Managing mark to market risk can be difficult because of how hard it is to quantify at any given time. In other words, just how damaging margin calls prove will depend on your individual exposures, as well as the severity and speed of those currency movements.

Predicting how much you could stand to lose is challenging but not impossible. The trick is to have a firm grasp over all of your hedging positions across counterparties and time frames.

Stress testing your positions against potential movements builds confidence and buy-in from all levels of your business. Meanwhile, value at risk models can be an effective tool in visualising risk. The problem is that few companies have sufficiently advanced technology to manage these problems strategically.

SmartHedge PRO consolidates all the tools you’ll need to manage treasury effectively, giving your business an instant snapshot of its mark to market risk. Our proprietary solution helps ambitious businesses across the country anticipate margin calls, stress test their current positions against a number of realistic scenarios, and protect their cashflow at times of market stress. To see SmartHedge PRO in action, take a tour of the product or explore our library of success stories.

As with all elements of treasury management, the key to dealing with mark to market risk is understanding the danger it poses to your business. Effective management requires planning and strategy, not short-term solutions. Smart Currency Business always look to implement comprehensive solutions that are robust enough to protect you from all eventualities.

Register with Smart Currency Business today or request a call back from our team to discuss how we can protect your business from risk.

020 7898 0500

020 7898 0500