How have the first ripples from the trade war impacted travel bookings? Editorial credit: Robert V. Schwemmer, via Shutterstock

Unprecedented uncertainty in the global economic picture has led to much navel-gazing in the travel community. While in theory only indirectly exposed to trade tariffs, the fear among travel firms is that barriers to trade will have several knock-on effects that could dampen demand as well as fundamentally change the way the industry functions.

As can happen during times of uncertainty, these fears range from understandable to the slightly neurotic. We’ve seen everything from reduced consumer spending to increased operational costs listed as concerns, but are travel businesses right to fear the worst? The answer, as it turns out, is a little bit more nuanced.

Farewell Disneyland?

The United States is a giant in the travel space, attracting millions of visitors each year. As the nation most inextricably linked to the political and economic fallout from tariffs, it makes sense that much of the early attention has centred on its huge tourism industry.

Already, the impact is being felt. Air traffic between the United States and Canada plunged by 40% year-on-year in February, when Canada was hit with an earlier batch of trade restrictions (plus some goading grandstanding from the President). A smaller decline was recorded among European bookings, although it should be noted that the impact will become much clearer in the long term.

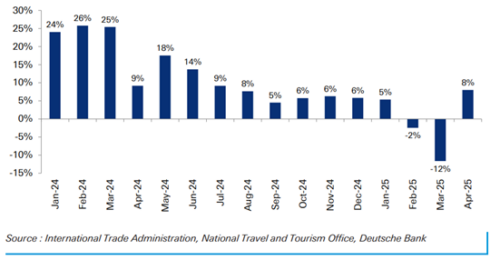

As Deutsche Bank recently highlighted, visitor numbers (as measured by border arrivals with plans to stay longer than a night) sank by 12% before bouncing back in April. While it is tempting to ascribe these falls to the geopolitical impact of the trade regime, the evidence is slim for this. In fact, the fall might be easier explained by the mundanity of a later Easter distributed demand later into April. Only time will tell.

The pinch of the purse

It is no secret that tariffs have caused a scramble in financial markets. JPMorgan and Goldman Sachs – two of the world’s most well-respected financial institutions – both slashed their growth outlooks for the United States and the world in the wake of 2 April. The recent climbdown has prompted relief, but the question of where we go from is one that has not been resolved.

Even with a limited trade deal, the UK and the eurozone could be nudged into recession by tariffs. With less growth and less money in their wallets, consumers might be minded to book fewer exotic holidays (particularly to destinations like the US) and stump for more local adventures, wherever those might be. However, as we saw after the COVID-19 pandemic, travel has been elevated very close to an essential for many consumers.

A global impact

Of course, the travel industry is made up of more than these three blocks. Around the world, tourism is emerging as a key driver of growth and a reflection of growing middle classes across Asia and the Middle East.

Countries like Vietnam, China, Spain, and Thailand are projecting significant declines in tourist arrivals this year, which would represent a massive economic disruption. The cruise industry is also experiencing shifts in booking trends due to the trade wars and associated economic volatility.

Amid the trade crisis, it’s important not to get too bogged down in the gloom. Yes, the combination of tariffs, political uncertainty and a deteriorating economic landscape are causes for concern. Yet the data that’s coming in is raw, and for now, there is little reason to believe passenger numbers and holidaymakers will crater. What is important is that travel businesses are aware of these challenges. After all, preparing for the worst and protecting yourself from risk is always a solid business model.

020 7898 0500

020 7898 0500