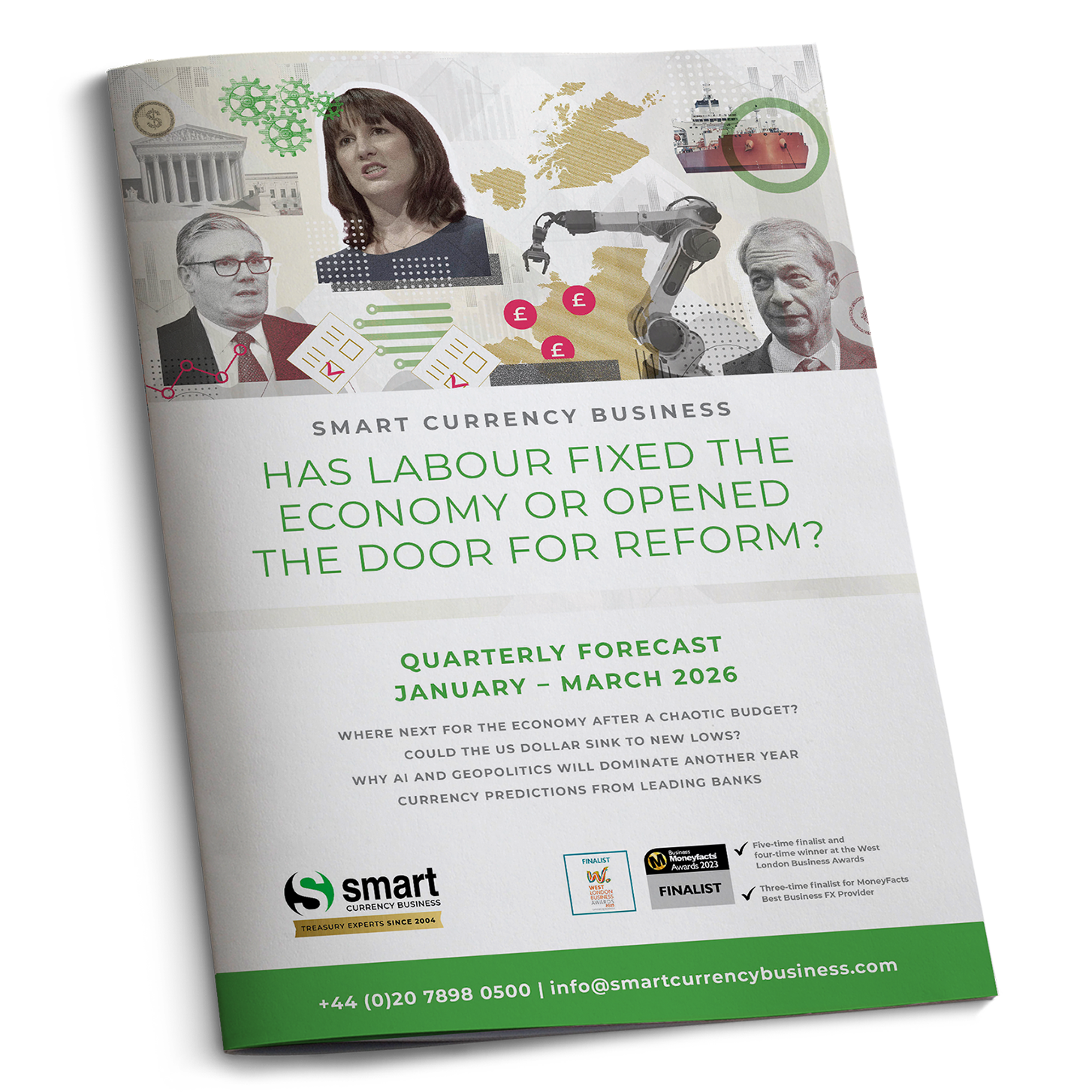

January to March Currency Forecast

Has Labour fixed the economy or opened the door to Reform?

In this report you will find:

- Has the UK economy finally turned a corner?

- Could the US dollar sink to new lows?

- Why AI and geopolitics will dominate another year.

- Plus, currency predictions from leading banks.

Don’t miss out – download your copy now!

Download your FREE Quarterly Currency Forecast

020 7898 0500

020 7898 0500