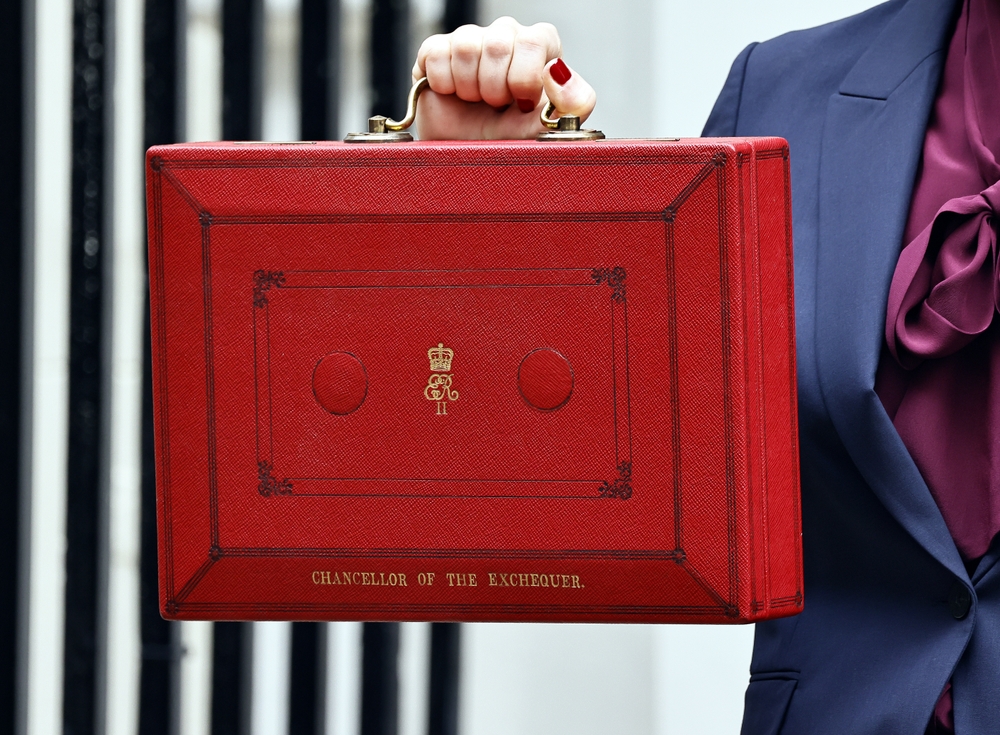

What will be in the box? (Sean Aidan Calderbank / Shutterstock).

UK Chancellor Rachel Reeves will deliver one of the most consequential fiscal statements in recent memory when she heads to the House of Commons on Wednesday 26 November. After months of speculation, the chancellor must somehow craft a budget that delivers on several competing targets. Among other things, the UK needs to increase its slender fiscal headroom, but it cannot afford to choke growth, which has puttered along in first gear for some time.

After her “coming clean” speech to the nation, it is clear to everyone that the Budget will contain tax increases. But what exactly might the chancellor announce, and more importantly, how will all this impact your business?

What we know and what we can’t know

Of course, we won’t know for certain exactly what will be laid out until the Budget is delivered. But based on interviews, reliable reports and a dollop of economic analysis, we have a pretty good idea of the bones of the plan. Let’s start with what the chancellor is herself saying:

“At the budget later this month, I will take the fair choices that are necessary to build the strong foundations for our economy so we can continue to cut waiting lists, cut the national debt and cut the cost of living”. The last two elements of this are crucial. Inflation has hit consumers hard, and persistently high prices have forced the Bank of England to loosen interest rates at only a cautious pace. There has been some suggestion that government policies have contributed to inflation, thereby reinforcing the vicious cycle of stagflation.

Here’s what we know for certain. Reeves will look to raise funds in the budget by either raising taxes, cutting spending, or even both. Issuing more debt is something of a nuclear third option, rendered remote or perhaps even impossible for the reasons laid out later in this article.

Possible Budget policies

The Labour government seem to have judged that tax rises are the least bad of the options available to them, despite manifesto commitments to the contrary. There are a number of ways they can do this that fall short of politically toxic increases to income tax or national insurance contributions. Extending the freeze on income tax thresholds (known as fiscal drag), for example, is a stealthy option but is projected to raise around £10 billion annually.

Word on the street is that Labour will opt to increase income tax by two pence in the pound, offset by an equal fall in national insurance contributions (NICs). How would that raise revenue? Well, it would mean more tax for people like pensioners and landlords, but would still technically prevent taxes from being raised on “working people”, the demographic theoretically protected by Labour’s manifesto wording. But make no mistake: any form of increase to income tax or NICs would come with a heavy price for the chancellor.

There is also a lot of noise around pensions. It is thought the government is looking to tighten rules around tax-free pension withdrawals (currently capped at 25%, or £268,275 in total value), and/or scale back employee salary sacrifice incentives. Both of these policies are just rumours, but they would be relatively low in political cost and would claw back billions for the Treasury.

Other options on the table include wealth taxes – particularly on assets, inheritance and emigration farewell taxes – council tax or stamp duty reform. Most of these would only contribute a billion or two pounds, but taken together, they would represent a significant windfall.

In total, it is thought that Reeves will have to find about £30 billion from behind the back of the sofa. That makes it likely that she will adopt a little of this, little of that approach. It might not be the Christmas smorgasbord the electorate wants, but it could disarm a full rebellion from Labour and the bond market.

How the bond market is dictating the Budget

The marketplace for UK government debt is governed by so-called “vigilantes”. That slightly derisory description is not entirely untrue. The bond market does effectively police fiscal policy, driving the cost of borrowing higher if they think the government’s choices aren’t sensible or sustainable and lower if they approve.

If you cast your mind back to 2022, its outsized role in fiscal policy was in full view. Liz Truss and Kwasi Kwarteng’s mini budget became a byword for the perils of uncosted spending. The pound sank, bond markets recoiled, and both Truss and Kwarteng were gone in a matter of weeks. The chart below shows those extreme movements.

Is the bond market holding the government hostage? We’ll leave that judgement to you. Regardless, it’s clear that Reeves will have to keep investors onside if she wants her Budget to go down as a success.

GBP to USD over the 2022 mini budget period:

What the Budget means for your business

After a tax raid in the spring, it would take a brave government to double dip on business taxes this autumn. But the risks to your business don’t end there. Should the ripples from the budget reach the bond market, there’s a good chance that your cashflow, mark to margin risk and other key financials will be affected by virtue of the distorting impact on sterling.

There’s also the political dimension to consider. Recent movement from Labour’s top brass suggest significant fault lines have opened, and Sir Keir Starmer has felt compelled to ward off manuevering in the background by the likes of Wes Streeting. Should Reeves resign, or should the Budget somehow result in the toppling of the Labour government, sterling would likely come under immense pressure.

As we well know, even a modest swing in the sterling to dollar rate can be disastrous. Successful businesses are able to navigate the uncertainty by protecting their cashflow and key financials with sound, comprehensive treasury policies. Relying on old, outdated solutions won’t cut it in this era of unprecedented uncertainty.

Register with Smart Currency Business today or request a call back from our team to discuss how we can protect your business from risk.

020 7898 0500

020 7898 0500